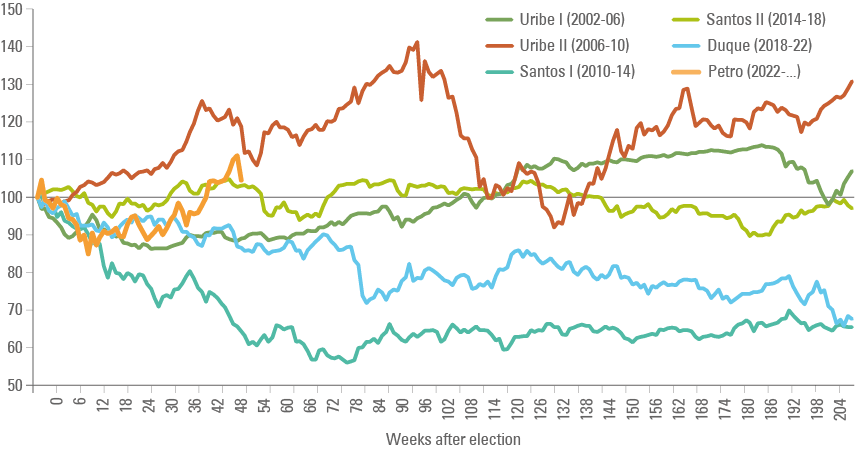

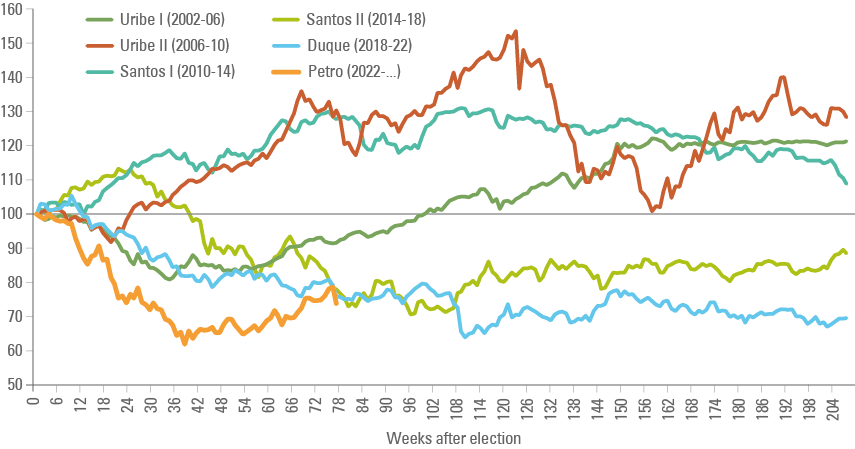

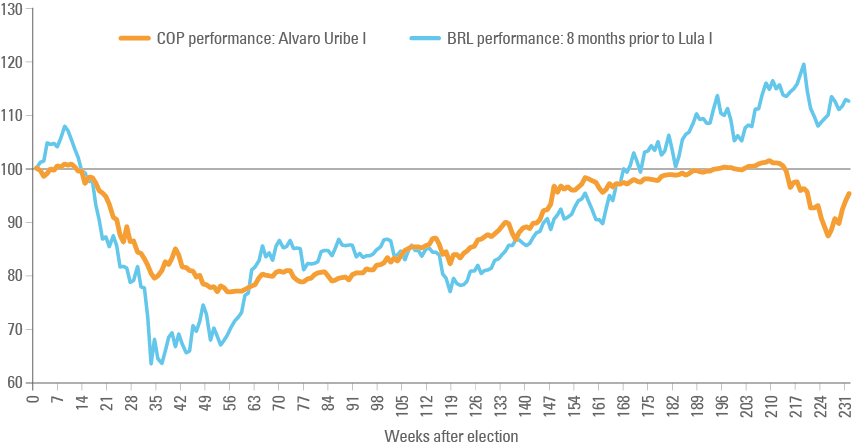

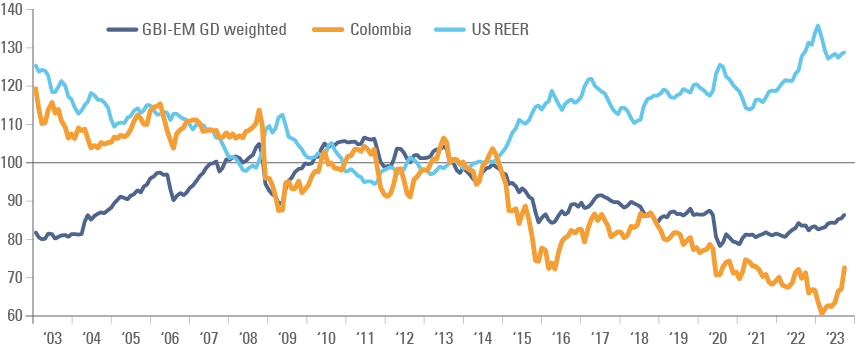

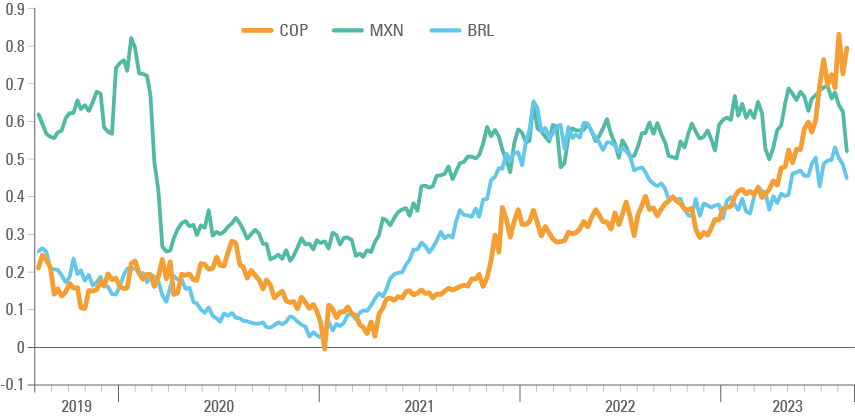

In our view, it is reasonable to expect the COP will follow the J-curve shape like Uribe’s first mandate, perhaps with even an more pronounced price increase from here. The COP’s continuous outperformance is contingent on two factors: (i) Petro moderating his stance and watering down his populist agenda, and (ii) the US Dollar continuing to depreciate.

2 | Capital flow reversal after political moderation: by hook or by crook

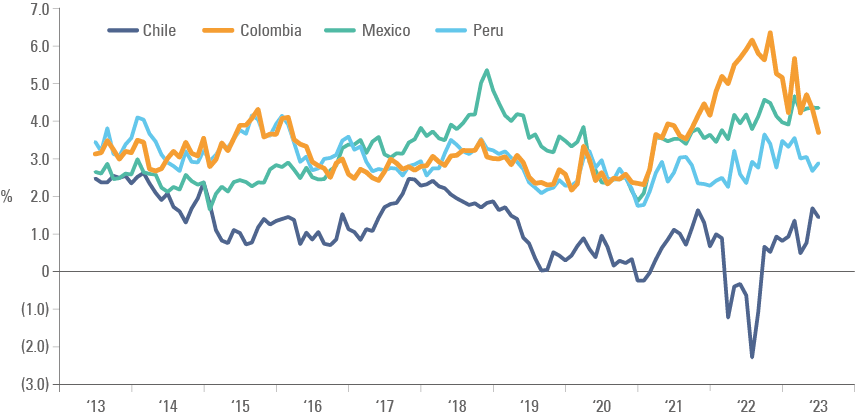

It is no secret that presidents are powerful. However, it is also no secret that, by design, economists are severely constrained in the ability to change their institutional systems. The ‘checks and balances’ in systems makes implementing populist measures much more challenging than feared. Peruvians will be familiar with the gap between a dysfunctional political environment concomitant with orthodox economic policies. In Chile, local investors sold local assets and bought overseas assets at a record pace due to fears of a more structural change in economic policies as Gabriel Boric looked to fulfil his pledge to deliver a new, more progressive constitution, only to find out that neither Chile’s Congress nor its people supported the first proposed constitution, leading to the drafting of a more conservative document. The end of large outflows led to a strong reversal of Chilean Peso (CLP) depreciation last year.

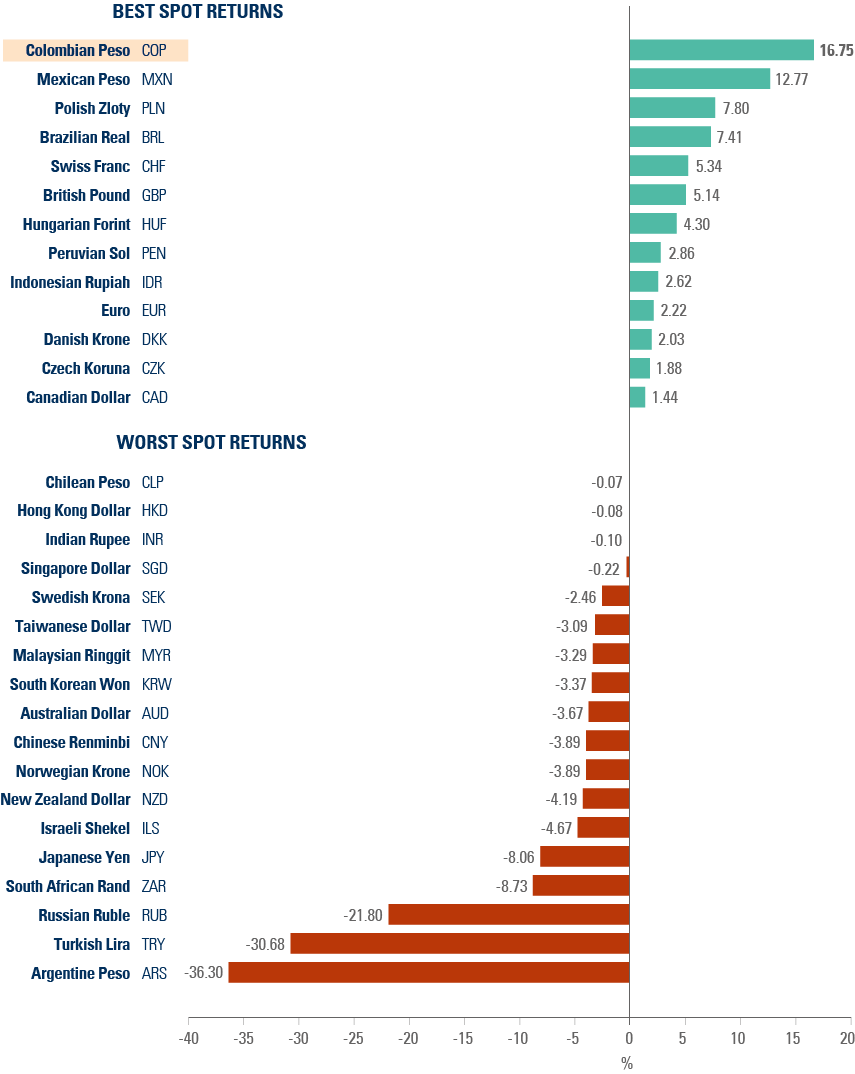

A similar story is playing out in Colombia, in our view. Flows from compensation accounts had a strong reversal, registering a USD 15.8bn outflow in the first half of 2023 after outflows of USD 19.8bn in H1 2022 and USD 18.9bn in H2 2022. Compensation accounts are used by local corporations as an instrument to keep Dollars abroad for trade and financial transactions. Furthermore, foreign direct investment started to increase again, resulting in an exchange surplus (current account balance flows rather than accrual) of USD 0.6bn in H1 2023, up from a USD 1.4bn deficit in H2 2022. Just like in Chile, Colombians ‘shot first and asked questions later’, and the massive outflows in the run-up to Petro’s election are hard to match, explaining the sharp reversal of COP performance year-to-date.

Interestingly, Petro is now reaching out to investors, touting a more pragmatist agenda.1 His economic team, initially led by José Antonio Ocampo and now by Ricardo Bonilla, is committed to consolidation of the country’s fiscal deficit, despite Petro’s leftist agenda. Last month’s announcement of the resignation of Energy Minister Irene Velez lowered the risk of an ill-advised sharp cut in fossil fuel energy production, which would have had a severe impact on Colombia’s external accounts.

Petro’s approval rating has been in decline since he came to power, so his political capital is undermined by his low popularity. The recent event where his elderly son Nicolas Petro were imprisoned for in a money laundering inquiry is very likely to be negative to the president, in our view. Initially, Gustavo Petro tried to disassociate himself from the issue, claiming he had nothing to do with the accusations and “wishing luck” to his son. However, last night Nicolas admitted receiving illicit money from a former senator convicted of drug trafficking, that went into his father’s 2022 presidential campaign.

It should not be surprising that ultra-conservative Colombians are fighting against a leftist populist agenda. Even though we believe Petro will keep pursuing a progressive economic agenda that conflicts with orthodox policies, in the end, a pragmatic compromise is likely to be reached, by hook or by crook.

3 | Dollar exceptionalism is over

In our view, the US Dollar peaked last year and has already entered a medium-term period of decline. We made the case against the Dollar clearly in a recent Ashmore publication.2 This session offers a summary of the main points.

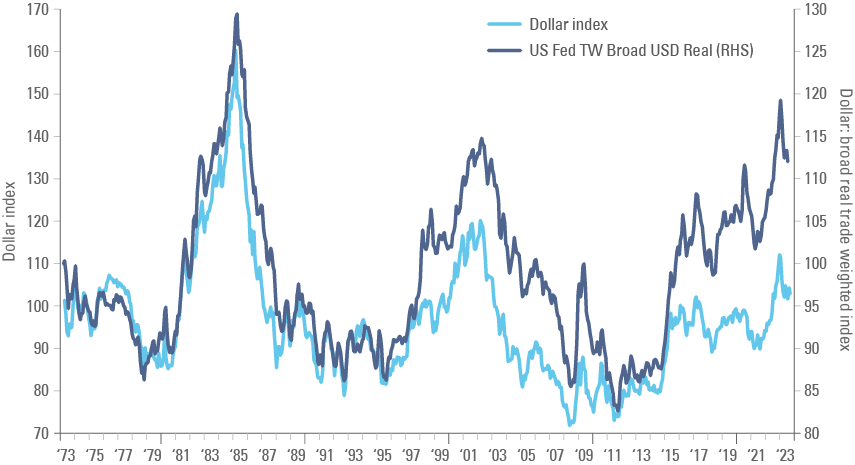

The US Dollar real effective exchange rate (REER), a gauge for long-term valuations, has peaked only 10% below the 1985 Plaza Accord levels, as per Fig 5. The ‘peak Dollar’ thesis is backed both by cyclical and long-term fundamentals.

Fig 5: USD index (DXY) vs. broad trade weighted USD in real terms: 1973 to 2023