September 6th, 2023

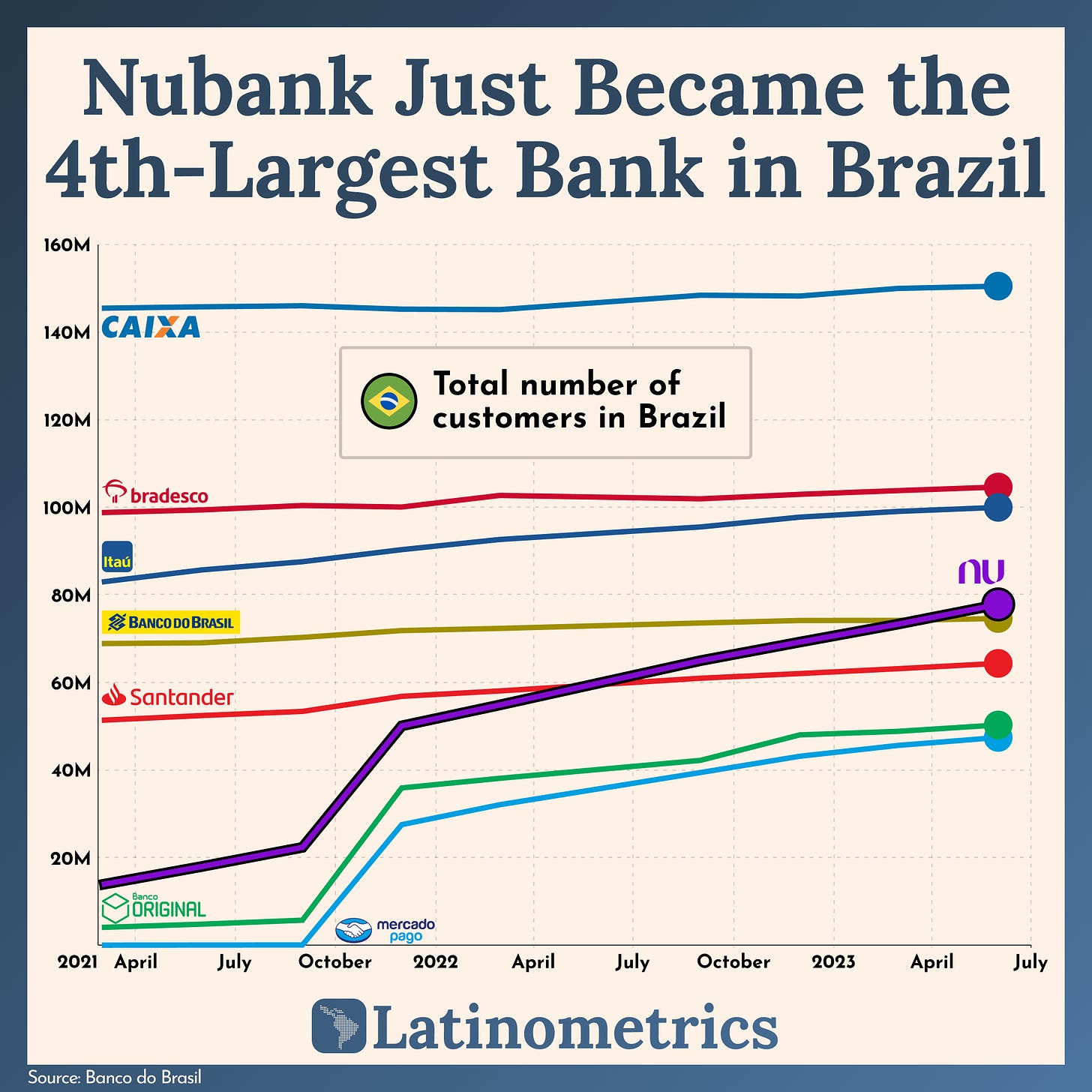

Via Latinometrics, a look at Nubank’s dramatic growth in Brazil:

If disruption were a chart, the above would be it. The five giant banks of Brazil, which collectively hold $1.5T+ in assets, have remained practically unmoved in terms of number of customers in the past two years. Nubank’s uprising is not new to them; the digital bank created a decade ago has been disrupting their modus operandi ever since.

But there’s little that these monoliths have been able to do to stop the meteoric rise and the fulfillment of, in its founder’s words, “the purple future.”

Clayton Christensen’s The Innovator’s Dilemma illustrates why giants often fail to adapt to disruptive technologies or business models. They focus on meeting the needs of their most profitable customers. The large Brazilian banks have been entrenched in their traditional ways, catering to their existing customer base and optimizing their proven business models.

Meanwhile, Nubank, without legacy systems and armed with talented leadership and technology, has focused on unserved or underserved customers, offering them a digital-first approach. Gradually, Nubank is moving up-market, improving its offerings, and beginning to challenge the incumbents not just on the fringes but at the core of their business.

Nubank’s ascent is poised to redefine customer expectations in Brazil’s (and LatAm’s) banking experience. As traditional banks scramble to compete and adapt, consumers will continue to see a rise in digital-first services and more customer-centric approaches across the industry. In the long term, the “purple future” sets a new baseline for what Latin Americans demand from their financial institutions.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.