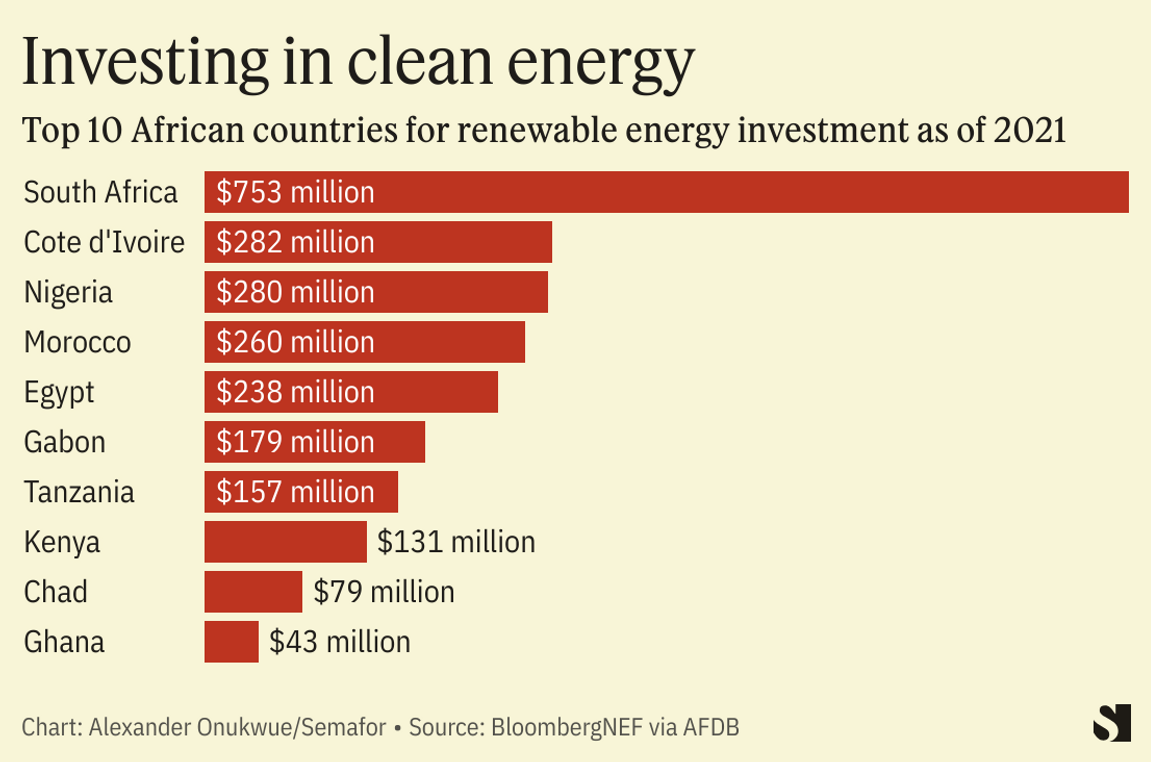

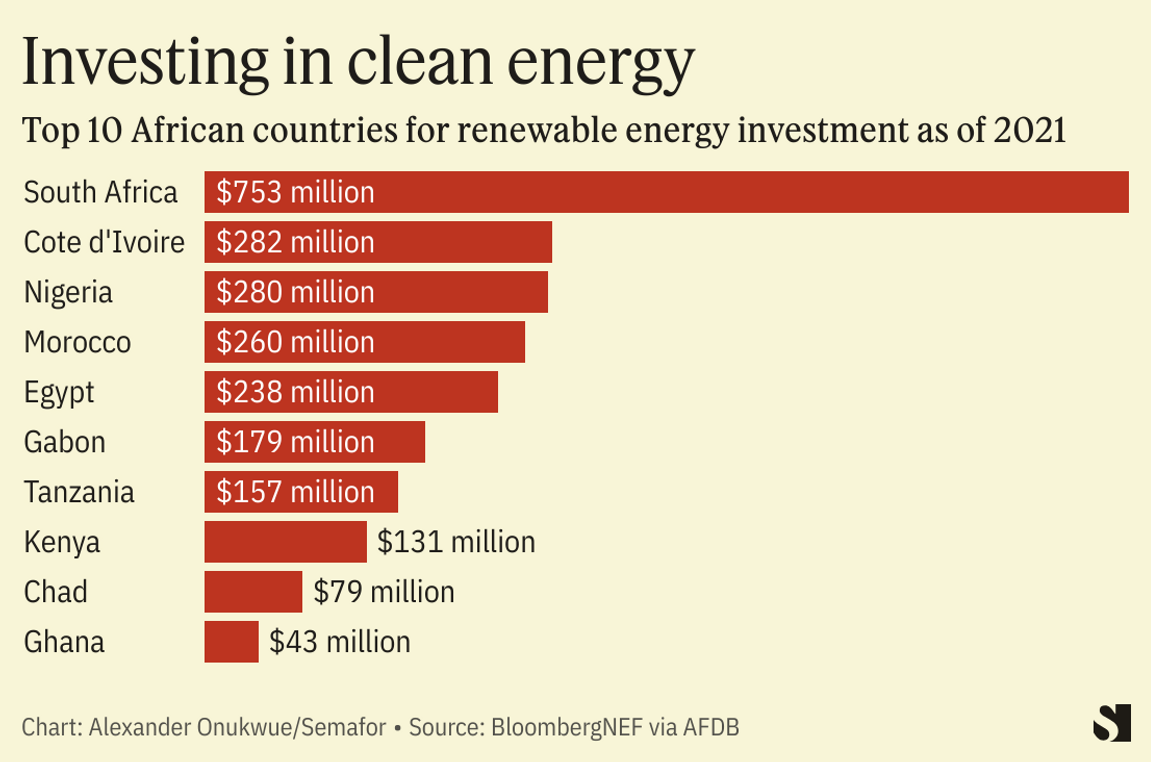

Investing In Africa’s Clean Energy Future

October 5th, 2023

Via Semafor, a look at where investment is going for clean energy in Africa:

|

|

|

A key aspect of global conversations around the clean energy transition relates to the financial cost of pivoting production systems in developing countries from current facilities that depend on fossil fuels to solar and wind sources. Most of the investment in Africa so far has gone to the continent’s largest economies. South Africa’s share is almost as large as the combined total of the next three in the continent’s top five destinations for renewable energy investment. The $280 million received in 2021 by Nigeria, Africa’s most populous country which has the continent’s biggest economy, “does not reflect the country’s full potential,” according to the African Development Bank’s (AfDB) latest report. Nigeria’s gas-fired power plants are only able to generate and transmit 3.1 gigawatts of electricity and a demand gap of 12.6 gigawatts remains unfilled, the AfDB says. Private companies have in recent years started offering industrial and household modes of solar-based energy.

|

This entry was posted on Thursday, October 5th, 2023 at 2:50 pm and is filed under

Chad,

Cote d'Ivoire,

Egypt. You can follow any responses to this entry through the

RSS 2.0 feed.

Both comments and pings are currently closed.