March 9th, 2024

Courtesy of Noahpinion, an interesting commentary on how Dune helps us understand real-life Middle East and the challenging political economy faced by resource-exporting countries in which more poorly resource-endowed East Asian nations may start out poorer but grow much faster:

I recently saw Dune 2, and it’s really good, despite a bit of a rushed second half. I highly recommend it. Anyway, everyone gets that Dune is an allegory for the Middle East, with the Fremen as the Bedouins and the “spice” — which is necessary for interstellar transportation, longevity, and various other things — as the oil analog.

But the economic historian Mark Koyama has taken the idea further. In a 2023 paper and accompanying blog post, he argues that the dysfunctional empire depicted in Dune naturally springs from an economy that’s dependent on one very valuable natural resource.

He writes:

The political economy of the galactic empire is a form of what Douglass North, John Wallis, and Barry Weingast term “limited access orders”. Limited access orders are a form of government that achieve a measure of peace and society order through the creation of economic rents for elites…

The greatest source of rents is the spice that can only be harvested on Arrakis…[H]arvesting it is extremely capital intensive…It is thus a monopoly granted to whichever House holds Arrakis in fief.

Like oil riches, spice produces a resource curse. It leads to the concentration of autocratic power both on the planet and in the galaxy at large…The empire Paul conquers following his victory at the end of the first novel is at least as oppressive and even more violent than the previous…empire.

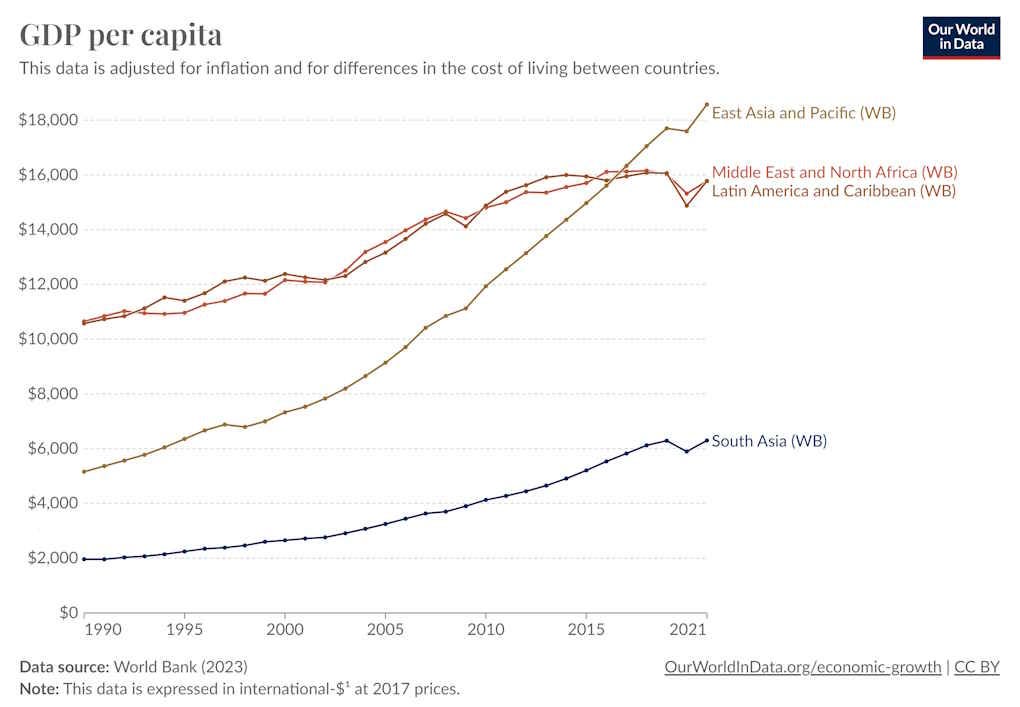

This is important for understanding why some countries get rich and others only get middle-class. Look at the GDP levels for the Middle East and Latin America — regions of the world with high levels of natural resource endowments per capita — compared with more poorly-endowed places like East Asia and South Asia.

The more poorly-endowed East Asia starts out poorer but grows much faster, and eventually passes up the rather stagnant resource-exporting regions. South Asia seems to be accelerating as well, and it’s not hard to imagine it also passing up the resource exporters in the future.

In other words, in a Dune-type universe, you don’t want to be Arrakis, whether it’s under the control of the Harkonnens or Paul Muad’dib. The dependence on spice will lead to a political economy where elites fight over control of the spice and generally leave the rest of society to hang. Fortunately, in our modern world, we have political units that are not ruled by resource exporters — the industrialized nations. It’s generally much nicer to be one of these. There are exceptions, of course — Australia is a very nice place to live, as are Norway and Chile. But in general, resource exporters face a very challenging political economy.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.