December 18th, 2015

Via the European Financial Review, a look at the growth and future of some of China’s cities:

China projects a huge and continually growing profile and impact on the world stage. Much of this Chinese influence globally is often anchored to and channeled out by its key cities. Shanghai towers over all these cities in what it stands and functions for China, as the country’s financial and trade centre, largest port (also the world’s top container port), and gateway to China’s huge domestic market. As such, Shanghai gets a lot of attention from the global business community, especially when its stock market tumbled recently and sent shock waves around the world.

Besides Shanghai, a variety of other cities have become more important for China, and the world economy, for that matter. A number of these cities are well known for their significant historic and contemporary economic and cultural roles such as Guangzhou and Xi’an. Other cities have risen from unknown origins to prominent economic centres like Shenzhen. There are also some much less known cities that have grown into new regional hubs with strong global connections. You most likely have not heard about them, names like Ruili and Yiwu.

In this article I take a new look at China’s key cities by focusing on two of their salient features. These cities are drivers of China’s local and regional economic growth. They also serve as bridges to link China’s varied local economies to regional and global markets. I examine both roles in how they play out in similar ways across four very different cities in scale and other dimensions: Shanghai, Chongqing, Yiwu, and Ruili (see their locations on Map 1).

Map 1: The Location of Four Key Cities in China: Shanghai, Chongqing, Yiwu and Ruili

Shanghai: Leading Nationally and Bridging Globally and Regionally

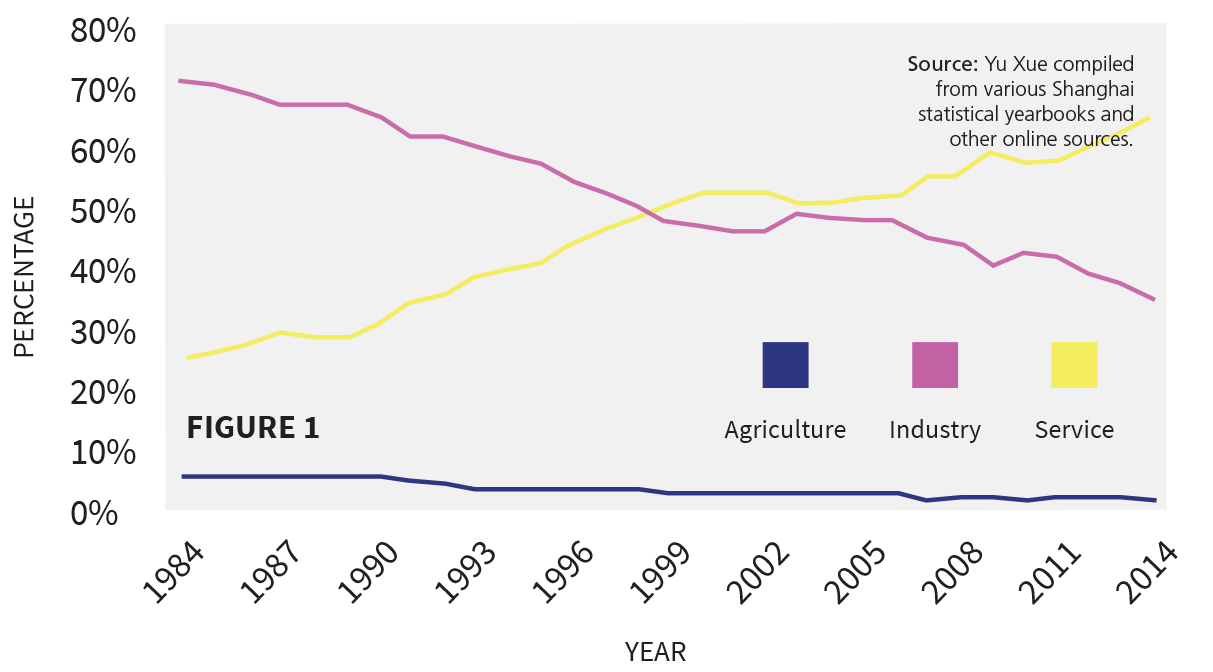

Shanghai’s transformation has been heavily studied over the past two decades. Yet here is another interesting way to look at how Shanghai itself has changed in leading China’s economic growth and global integration. Compared to all major cities in China, Shanghai has undergone the most striking and sustained shift from manufacturing to services (see Figure 1).

Figure 1: Shares of Agriculture, Industry and Service in Shanghai’s GDP

During the first half of the 1984-2014 period, Shanghai was more of a manufacturing centre as it was built up to be during the centrally planned era from 1949 to the early 1980s. The second half from the late 1990s saw Shanghai move steadily towards a service economy. This trend not only puts Shanghai’s economic transition ahead of all other manufacturing-oriented cities in China but also places Shanghai on a similar pathway like other global cities as important service hubs.

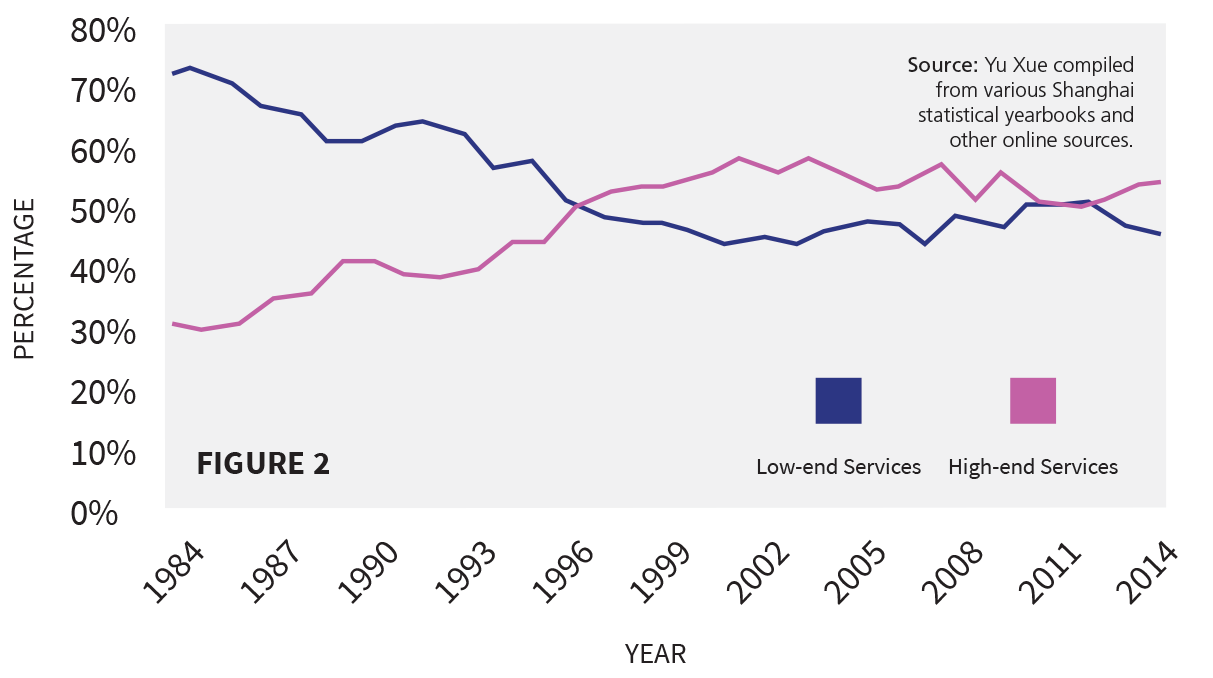

Shanghai is indeed on track to resemble the economic profile of global cities like New York and London (see Figure 2). As Shanghai’s service sector as a share of GDP has surpassed manufacturing, its high-end or producer services like finance, insurance and real estate (FIRE) have grown faster than low-end services like retails. This shift reflects the faster and greater concentration of international banks in Shanghai, mostly in the Pudong financial district. More than half of the foreign-owned banks and their branches operating in China are registered in Shanghai. The assets of foreign banks in Shanghai accounts for 47.3% of the foreign banks’ total assets in China. Shanghai’s banking dominance today brings back its heyday in the early 1930s when it ranked the world’s third banking centre, only behind New York and London and ahead of Hong Kong and Tokyo.

Figure 2: Shares of Low vs. High-end Services in Shanghai

As Shanghai marches (back) to its historic global city status, it has also been leading and driving the China’s major manufacturing cities in developing stronger services. At the same time, Shanghai plays a growing part in bridging the global economy with the Yangtze River Delta (YRD) region of which it has been the unquestionable hub (Figure 31). With the shedding of manufacturing functions to second-tier YRD cities like Suzhou, with subcontracting ties to even smaller cities, Shanghai has strengthened its position as the regional core by adding more critical and high-value-added functions such as corporate headquarters and R&D centres. By October 2014, Shanghai secured 484 regional headquarters of multinational corporations, of which 24 were Asia-Pacific headquarters, 295 investment companies, and 379 R&D centres.2

Besides being China’s premier international city, Shanghai continues to lead China’s major cities in transitioning towards a service-oriented and advanced local economy. This has also paralleled Shanghai’s stronger role in connecting and integrating the YRD region with the global economy, driving forward one of the world’s largest and most powerful regional economies.

Chongqing: Shanghai of the West

About 2,400 kilometers up the Yangtze River from Shanghai in western China is the city of Chongqing (Map 1). With over 30 million people in its sprawling administrative boundary, Chongqing may be “the largest city in the world that few people know about.” Chongqing drew some global attention in 2012 when Bo Xilai, the then Party secretary of Chongqing Municipality, was sacked and then imprisoned for what the central government labeled as corruption and other criminal activities.

If we take a much longer historical perspective, Chongqing has always loomed large among China’s major cities, even relative to Shanghai. Chongqing had a small concession zone as an inland treaty port after 1891, with a little similarity to Shanghai’s dominant treaty port status after the first Opium War in 1842. But Chongqing was hindered by its position as a mountain city close to the headwaters of Yangtze and languished as a distant backwater.

Chongqing was never cosmopolitan until the outbreak of the war of resisting Japan in 1937 and when the Nationalist government moved its capital to Chongqing in 1938. Being China’s political centre then in the first half of the 1940s propelled Chongqing to the largest financial, aviation and even cultural/fashion centre in interior China, second only to Shanghai.

Chongqing after 1949 was down and up. The uptick phase began during the Cultural Revolution. Concerned about a potential Soviet attack, the central government designated Chongqing as the core of the “Third Front” for hosting the relocated heavy industries from the coast. This turned Chongqing into a “Little Shanghai” that would lead the nation in developing defense-related machinery and ship-building industries. Chongqing ended up receiving 122 enterprises in these industries from Shanghai with a large pool of human talent in engineering and technical professions. In spite or because of this external transfer of resources, Chongqing neglected local advantages as the natural and potentially autonomous hub for the upper Yangtze region in achieving a more balanced development of housing, infrastructure and amenities of city life.

Chongqing got a big boost in 1997 when it was elevated to the fourth central government municipality besides Beijing, Shanghai and Tianjin. It would now cover 82,403 square kilometers and encompass a population of over 30 million. This designation brought about a great deal more autonomy by making it function as a province, and one of the most important ones at that, and thus setting it onto the most remarkable phase of growth and change in its long history.

Starting in 1997, the central government would give Chongqing $240 million as low-interest loans per year for the Three Gorges Dam-affected region, $80 million for building new housing for displaced residents, and refund $85 million from import taxes to Chongqing for Dam-related projects. In addition, Chongqing was allowed to lower enterprise tax for new foreign investment projects from 33% to 24%, or even to 15% if these projects were located in its economic and technological development zones.

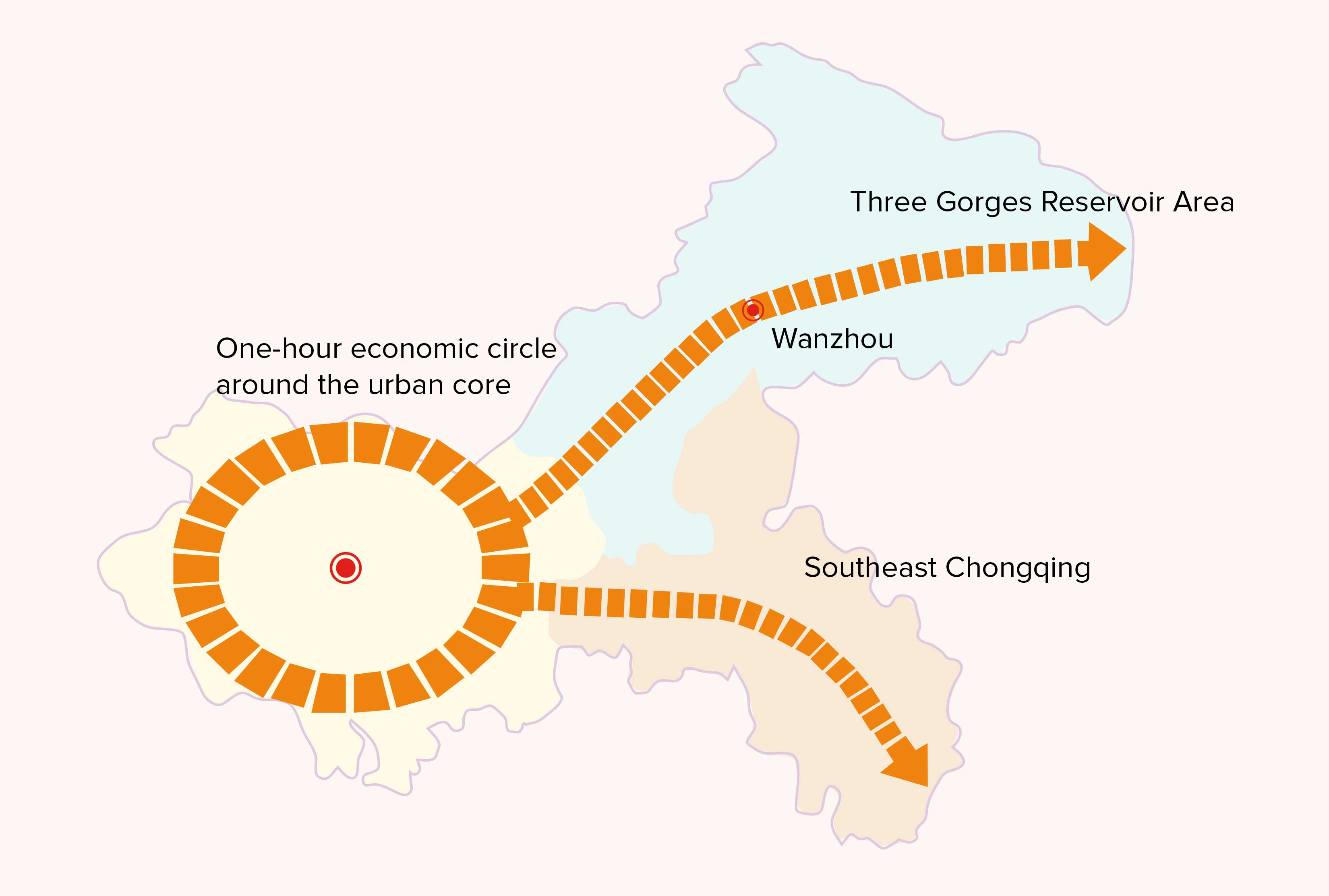

The launch of China’s “Go West Campaign” in 2000 moved Chongqing up another notch to finally become the undisputed economic hub for the upper Yangtze region, or the “dragon’s tail” relative to Shanghai as the “dragon’s head” for the YRD. To live up to this ambitious goal, Chongqing unveiled the “One Circle and Two Wings” (see Map 2) master plan in 2007. It would accelerate the pace and spread of urbanisation and economic development from the enlarging urban core into the two largely rural subregions. It called for converting about 10 million rural residents of Chongqing Municipality to urban dwellers by around 20203, through the building up of several secondary cities like Wanzhou.

Map 2: Chongqing’s “One Circle and Two Wings” Development Plan

Source: Chongqing Municipal Planning Bureau.By building up the municipal and transport infrastructure in and around these secondary cities, the municipal government can scale them up and out so they are capable of accommodating more rural people and also pushing some development impulses deeper into the distant and poorer areas of Chongqing’s sprawling regional hinterland. If successful, this strategy will replicate a similar regional bridging role as Shanghai.

Like Shanghai’s global connective functions but from a less advantaged interior position, Chongqing launched the 11,179-kilometer Trans-Eurasia Railway from southwestern China to Duisburg, Germany, through Kazakhstan, Russia, Belarus and Poland in 2011. In 2005, Chongqing also opened seven new international flights to Paris, Vancouver, Los Angeles, Sidney, Melbourne, New Delhi and Mumbai, even though they all connect through Shanghai. As labour and land costs in coastal cities like Shanghai have gone up, Chongqing has benefited by attracting more foreign investors and domestic producers to move inland. Having set up Asia’s largest laptop factory in Chongqing, US computer giant Hewlett Packard has already shipped more than four million notebook computers to Europe by the Chongqing-Duisburg railroad. This was part of the $2.5 billion worth of goods China has shipped on this route since 2011.4

Yiwu: Relatively Small Yet Very Global

As the megacities of Shanghai and Chongqing continue to garner global attention, little remains known about China’s much smaller cities, although more of them have begun to play similar roles in driving local and regional growth and in fostering beneficial global connections. I start with the story of Yiwu. Few people outside of China have heard about Yiwu and how it has become one of the most globalised cities in China today.

A small rural town of Zhejiang province in the late 1970s and located from 300 kilometers from Shanghai, Yiwu was an early beneficiary of China’s initial wave of decentralisation and economic reform. With a lot of local autonomy, the local government steered local market and global economic forces in jump-starting rapid urban growth through careful planning and flexible policies. Instead of building many factories in spatially distinctive industrial districts like Shenzhen and other coastal cities, Yiwu chose a commercial route and charted a new path to globalise its own local economy.

From the very outset, the local government focused on promoting spatially centralised and specialised markets and vending booths for small merchandise such as handicraft items and hand tools. These commodities found home at thousands of booths amassed in the International Trade Mart (Yiwu Market) located in a huge mall-like structure of 4.7 million square meters built by the local government (see Figure 4). In 1982 there were only 705 booths in this trade centre. Fast forward to 2004 the number of booths shot up to 42,000, which are estimated to reach roughly 65,000 in 2014.

These booths display and sell 300,000 different kinds of merchandise goods in specialised markets for glass gifts, wooden gifts, pencils, office supplies, jewelry, toys, radios, earphones, socks, clothes, etc. Some refer to Yiwu as “The Socks City” because it supplies an enormous amount of socks to the world. In addition, 600 factories around Yiwu make about 60% of the world’s Christmas decorations.6

As small commodity booths grew in numbers and density, they attracted hundreds of thousands Chinese and international buyers and traders. The increase in commercial transactions spurred the expansion of small factories around the region surrounding Yiwu. These factories process and assemble more small merchandise to be sold at and exported from the city’s central mart. This trade-manufacturing relationship, on a much smaller scale, bears some resemblance to the dominant trading and marketing specialisation of Shanghai with backward manufacturing ties to the YRD regional economy (see Figure 3).

The regional integration of Yiwu as a globally connected small merchandise hub has fueled the ten-fold growth of the city’s population from 1990 to around one million today. Among the long-term local residents are approximately 10,000 foreign businessmen from 85 countries working for over 3,000 foreign trading companies. This has earned Yiwu the moniker as “the largest commodity wholesale market in the world” with a market index that is widely regarded as a barometer of prices and performance.

The recent installment of the Yiwu-Madrid Railroad further highlights Yiwu’s extensive global economic reach. Covering 13,500 kilometers, this railroad goes through eight different countries as the world’s longest. It begins from Yiwu through central China, joins the Trans-Eurasia Railway at Kazakhstan, continues on from Germany to France, and finally reaches Madrid. The train takes just three weeks to complete a journey that would take up to six weeks by sea. It is also more environmentally friendly than road transport, which would produce 114 tonnes of CO2 to shift the same volume of cargo, compared with only 44 tonnes produced by the train – a 62% reduction.7This new rail line expands Yiwu’s global trade in small merchandise by making it easy to export its goods all over Asia and Europe.

Ruili: From a Small Border Town to a Major Gateway to Southeast Asia

The last city takes us back from the coastal region to the southwest, but all the way to the border city of Ruili in Yunnan province (Map 1). A sleepy town on the border with Myanmar through the 1980s, Ruili has since grown into a key city for driving lagged economic development in its border region and bridging the latter with the neighbouring Southeast Asian economies. In this process Ruili has acted a little like Shanghai, albeit on a much smaller scale, and in similar ways as Yiwu but with a smaller scope of local marketing.

The collapse of the Burmese Communist Party at the end of the 1980s was key to opening up border trade between China and Myanmar. The city of Ruili created the Jiagao Border Economic Development Zone in 1991 to facilitate trade with Muse on the Myanmar side. At Ruili’s border trade market, hundreds of petty traders and dealers from Myanmar, Bangladesh, India, Nepal, Pakistan and Thailand selling cotton, jade, bracelets, ivory items and aquatic products. The market however is dominated by Chinese and Myanmar jade traders who converge from local and other places in their respective countries to make jade the central focus of Ruili’s lively border trade.

Ruili’s importance rose much beyond a border market in June 2010 when the city became more regionally linked to China’s strategic plan to develop its vast western region. During 2012-2013, the central and local governments began to execute the “Implementation Scheme of Ruili Experimental Zone” and the “Master Plan of Ruili Experimental Zone” in order to build Ruili up to a regional hub. The Master Plan included 238 projects such as industrial parks and trading centres, which would boost Ruili as a gathering place and gateway for economic activities and flows with the neighbouring Southeast Asian economies including a new oil/gas pipeline from western Myanmar into Yunnan.8

The new infrastructure investment strengthened Ruili’s role as an increasingly open land port. In December 2013, the Ruili Experimental Zone began issuing border passes for cross-border travel, which has facilitated the growth of cross-border tourism, especially Chinese tourists visiting Myanmar. The Experimental Zone also became a testing area for foreign current exchange making Ruili the first city in China to trade Myanmar’s currency of Kyat, and also the first county-level city in Yunnan province to establish a currency exchange centre. As of June 2015, Ruili completed hundreds of business deals amounting to over $160 million.9 The cumulative economic opportunities have raised Ruili’s population from around 10,000 in 1990 to over 150,000 today including temporary migrants.

Parallel to the cross-border economic boom has been the flow of illegal or illicit activities into and through Ruili. This is not surprising considering that the China-Myanmar border zone is infamous for gambling, commercial sex, drugs, and arms trafficking. Official figures show that Ruili has 7,700 people with HIV – the second-highest prevalence incidence rate in China behind a city in Sichuan province – and 53% of the sufferers come from Myanmar.10Of the approximately 40,000 people from Myanmar entering and leaving Ruili, more than 200 are estimated to be prostitutes, 1.6% of whom may be infected with HIV. There are also around 30,000 people from Myanmar, many of them belonging to the persecuted minority group of Rohingya, living in Ruili, adding to the challenge of local governance. As part of a broader effort to deal with drugs and prostitution and thus maintain social stability, the local government has set up clinics for Myanmese citizens who are infected with HIV or who are drug addicts in Ruili including the provision of methadone treatment (see Figure 5).

Compared to Shanghai, Chongqing and Yiwu, the frontier city of Ruili bordering the less developed economy of Myanmar faces a different balance of opportunities and challenges. These however reflect the transformation of Ruili from a local place to a global city of sort.

Figure 3: Regionalised Global-Local Production and Value Chains Into, Through, and Out of Shanghai and the Yangtze River Delta (YRD) Region

Source: See Note 1.A multinational company owns brand names, sets product specifications, subcontracts manufacturing and controls wholesale channels and retail markets. Shanghai (central hub of the YRD) contributes land, some capital, skilled labour, some production equipment, and management expertise; provides some producer services such as accounting, insurance, legal services, custom clearance, shipping logistics and increasingly R&D talent and outputs. Suzhou, Kunshan, and Jiaxing (secondary cities in the YRD) contribute medium-cost land and labour, intermediate inputs, manufacturing expertise, and also finished products to be moved (back) to Shanghai for exports. Wujiang, Qidu and Jiangcun (third-tier cities, fourth-tier towns, fifth-tier villages in the YRD) contribute lowest-cost land and labour, some raw processed materials, and ships parts and components to secondary cities for further assembling or manufacturing.

International Implications

Despite their huge differences in history and population size, these four cities have become both the driving force and bridging agents for their rapid growth, gradual regional integration and increasing global influence. They are no longer local places that they once were, although Shanghai has been global for a much longer time. They show us why they are key cities for China today and in the future. More importantly, these four cities point two critical international implications.

First, to understand what is going on across China and its extensive global impact, we need to understand China’s key cities much better. These cities not only continue to drive and sustain China’s geographically uneven growth but also play a key role in regional integration by creating more varied and largely beneficial global connections. We can no longer only focus on the megacities of Shanghai and Chongqing, although their massive scale and economic power will continue to matter a lot more to China’s and global economy than Yiwu and Ruili. The latter cities, and many more like them, will become more important over time as they catch up in development and help bring forth the lagging regions and generate more global integration.

Relative to the much larger and more diversified cities like Shanghai and Chongqing, cities such as Yiwu and Ruili face the more difficult choice of how to sustain their growth and play their respective regional or global roles. The narrowly specialised economy makes Yiwu vulnerable to the price volatility in the global economy. Yet diversification beyond Yiwu’s distinctive and entrenched strength is unlikely. The border location may lock Ruili into a developmental path built on border trade unless the city can maximise its gateway position to create wider economic ties with Southeast Asia. These uncertain and contingent conditions will continue to challenge the outside world to better understand these cities.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.