July 28th, 2021

Via Visual Capitalist, an interesting look at the world’s largest ten (10) economies in 2030:

World’s Largest Economies in 2030

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

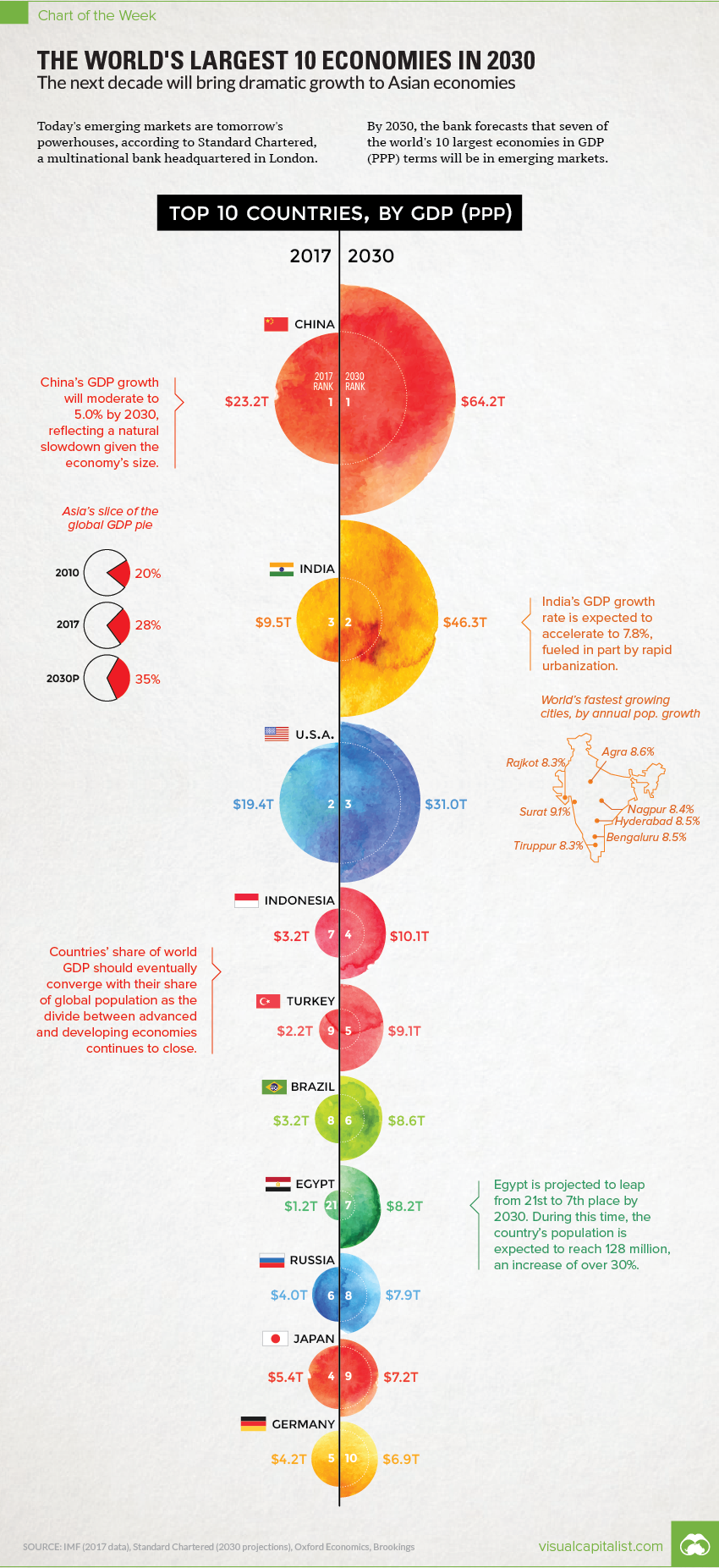

Today’s emerging markets are tomorrow’s powerhouses, according to a recent forecast from Standard Chartered, a multinational bank headquartered in London.

The bank sees developing economies like Indonesia, Turkey, Brazil, and Egypt all moving up the ladder – and by 2030, it estimates that seven of the world’s largest 10 economies by GDP (PPP) will be located in emerging markets.

Comparing 2017 vs. 2030

To create some additional context, we’ve compared these projections to the IMF’s most recent data on GDP (PPP) for 2017. We’ve also added in potential % change for each country, if comparing these two data sets directly.

Here’s how the numbers change:

Rank Country Proj. GDP (2030, PPP) GDP (2017, PPP) % change #1 China $64.2 trillion $23.2 trillion +177% #2 India $46.3 trillion $9.5 trillion +387% #3 United States $31.0 trillion $19.4 trillion +60% #4 Indonesia $10.1 trillion $3.2 trillion +216% #5 Turkey $9.1 trillion $2.2 trillion +314% #6 Brazil $8.6 trillion $3.2 trillion +169% #7 Egypt $8.2 trillion $1.2 trillion +583% #8 Russia $7.9 trillion $4.0 trillion +98% #9 Japan $7.2 trillion $5.4 trillion +33% #10 Germany $6.9 trillion $4.2 trillion +64% Possibly the biggest surprise on the list is Egypt, a country that Standard Chartered sees growing at a torrid pace over this timeframe.

If comparing using the 2017 IMF figures, the difference between the two numbers is an astonishing 583%. This makes such a projection quite ambitious, especially considering that organizations such as the IMF see Egypt averaging closer to 8% in annual GDP growth (PPP) over the next few years.

The Ascent of Emerging Markets

Egypt aside, it’s likely that the ascent of emerging markets will continue to be a theme in future projections by other banks and international organizations.

By 2030, India will be the second largest economy in PPP terms according to many different models – and by then, it will also be the most populous country in the world as well. (It’s expected to pass China in 2026)

With the divide between emerging and developed economies closing at a seemingly faster rate than ever before, this should be seen as an interesting opportunity for all investors taking a long-term view.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.