July 26th, 2022

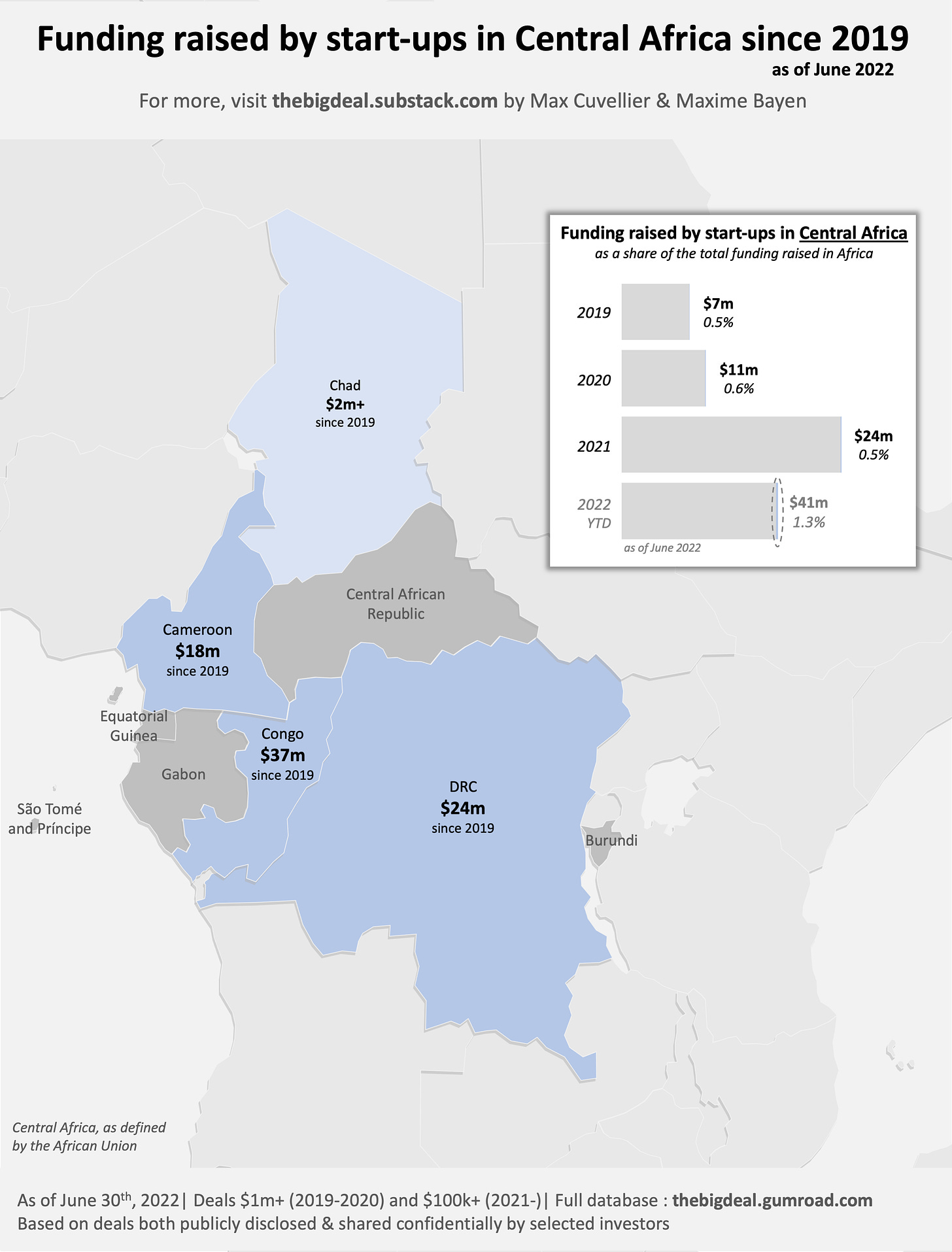

Via Africa: The Big Deal, a look at how Central Africa has claimed less than 1% of all the funding raised by start-ups on the continent since 2019:

After covering Eastern, Northern, Western and Southern Africa, our last stop on our tour of the continent’s regional ecosystems naturally takes us to Central Africa. With only $82m+ raised by start-ups since 2019, the region is punching below its weight. Indeed, it represents less than 0.8% of the total funding raised during the period, to be compared with its share of the continent’s population and GDP: 13% and 6% respectively. In particular, the region lacks a champion that could attract attention and capital to its neighbours. With $24m raised since 2019, the DRC – the largest country in the region in terms of both population (105m+) and GDP (~$55bn) – does not play in the same league as the ‘Big Four’ but instead ranks along a Rwanda or a Côte d’Ivoire. Congo tops the regional list, yet the full amount was raised by one single start-up in 2022: Jambo, which successfully closed a $7.5m Seed round in February, and a $30m Series A round in May. This deal was the first 8-digit round ever recorded by a start-up in the region, and remains the only one so far. Cameroon and the DRC’s fundraising activity relies on a wider variety of deals, yet we are only talking about a dozen of deals each in the past 3.5 years. Overall, it does not mean that there isn’t money flowing into the region (e.g. through PE deals in the solar space), but this money is yet to reach the local start-up ecosystem in large numbers.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.