December 24th, 2009

Courtesy of Seeking Alpha, an interesting look at the continued rise of national oil companies:

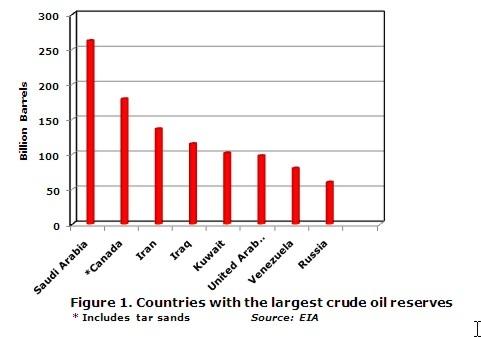

“…Iraq currently boasts the world’s third-largest proven reserves of conventional crude oil, behind Iran and Saudi Arabia. Figure 1 shows countries with the largest crude oil reserves. If Canada’s tar sands were factored in, then Iraq would be edged into fourth place. Oil and gas data for Iraq, however date back more than three decades, long before the technological improvements that have transformed the oil and gas industry. The implication then is that the figures for the country’s recoverable reserves are most likely significantly higher than previously reckoned. This may have informed the bids entered by companies in the second Iraqi oil block auction, which was held last week.

The auction for ten oil service contracts (as distinct from outright concessions or production sharing contracts) was a testament of sorts to the increasing dominance of National Oil Companies, NOCs in the global oil and gas sector. West Qurna Phase 2, the largest oilfield (about 12.9 billion barrels) offered by the Iraqi government at the licensing round was won by the Russian privately held company, Lukoil (LUKOY.PK) in association with Statoil (STO), Norway’s state-controlled oil company. This was closely followed by the Majnoon (about 12.6 billion barrels) field won by Royal Dutch Shell (RDS.A) (45%) in association with Petronas (PNAGF.PK) (30%), the Malaysian NOC. The Halfaya field (about 4.1 billion barrels) was won by a consortium led by the Chinese NOC, CNPC in association with Malaysia’s NOC, Petronas and the major, Total (TOT) (the Iraqi government took up the balance). Petronas won the bid for the Garraf (about 863 million barrels) field in association with Japex. Sonangol, the Angolan NOC won bids for the Najmah (about 800 million barrels) and Qaiyarah (about 858 million barrels) fields. Even the smaller field Badra (about 109 million barrels), was won by a partnership of four NOCs.In all, Petronas and Sonangol were involved in five successful bids. Only three European International Oil Companies, IOCs, were successful, while no U.S. IOC was successful. Angola, on the southwest coast of Africa recently joined the Organization of the Petroleum Exporting Countries, OPEC and has since ramped up her production. The country’s offshore fields are part of the massive Atlantic petroleum provinces of Africa. China’s NOC entered the most bids by any company and won two majority stakes while two Russian companies (the NOC Gazprom (OGZPY.PK) and the privately held Lukoil) were successful.

The auction provided for the Iraqi government to pay the companies a bid amount for each barrel of crude oil produced by the companies above current production levels. The comparatively low bid values entered by the companies were indicative of the keenness of the competition. For example, the winning bid by the Royal Dutch Shell and Petronas partnership (which pledged to raise production to 1.8 million barrels per day, bpd, from the current 46,000 bpd) for the Majnoon field was US$1.39 per barrel, well below a delighted Iraqi Oil Ministry’s expectation. That for the Halfaya field entered by the CNPC consortium was US$1.40 per barrel. The latter pledged to raise production from the current 3,000 bpd to 535,000 bpd.

In a previous post, l discussed the challenges facing International Oil Companies. Essentially, in addition to the increasing difficulty to profitable discovery and production of crude oil, they face increasing threats from NOCs. For example, the Chinese NOCs, bolstered by an intimidating financial war chest (often procured on more favorable terms than IOCs can), lower operating costs (in terms of labor and materials) and the leverage of state (which can confer the ability to operate even in the world’s high-risk zones, and that, without shareholders’ scrutiny) are increasingly unassailable. Other NOCs (and many of them with very large, state oil and gas reserves domiciled with them) are not too far behind.

Many of the IOCs such as Royal Dutch Shell, BP and ConocoPhilips (COP) have recently reduced staff strength and spun off assets in initial cost-cutting and restructuring measures. Synergies in partnerships (such as these) with NOCs also offer IOCs avenues for viability in the face of fierce competition. A partnership between BP and the Chinese NOC, CNPC for example, for the development of the Rumaila field (Iraq’s largest, with about 17 billion barrels), was the only successful bid in Iraq’s first licensing round which held in June. Mergers and acquisitions (such as the recent acquisition by ExxonMobil (XOM), of XTO Energy) may be next. The said recent acquisition may provoke a series of M&A activity involving major IOCs and shale gas companies. The not-too-good news is that questions remain about the viability of shale gas though technological advances may just do the trick. In a related development, Royal Dutch Shell reportedly reached agreement with the Republic of South Africa to carryout a preliminary study on a prospective hydrocarbon field in the Karoo Basin, which will grant the company exclusive exploration rights to the field, believed to be a natural gas field.Current natural gas inventories in the U.S. are still high, while the price regimes are not at their best. With high levels of financial exposure by some of the shale gas companies, ExxonMobil, with a much larger financial war chest and reputable research and development facilities, may be better placed (than these smaller shale gas companies) to develop the shale gas technology and perhaps extend to foreign shale formations.Iraq’s second postwar oil licensing round was widely believed to be successful. Many oil companies keenly vied for one of the world’s largest, largely unexploited, easily accessible and cheaply exploitable crude oil reserves remaining. The process is expected to boost the country’s production capacity to more than 11 million bpd from the current 2.4 million bpd within ten years; and this could top the dominant Saudi Arabia. Since Iraq is also an OPEC member, what adjustment this would necessitate among OPEC members’ production, remains to be seen. Such substantial addition to global production may also significantly moderate prices subject of course to geopolitical considerations.That said, it is “not yet Uhuru” for Iraq’s oil and gas sector. For example, these contracts still have to be ratified, and that, probably after next year’s elections. All parties to the auction remain cautiously optimistic that a new regime would respect the contracts and not nullify them.In addition, several hotly disputed fields such as those in the Kurdish areas remain flash points, while fields such as the massive (eight-billion barrel) East Baghdad situated in politically unstable and terrorism-prone areas were largely avoided.

Even where bids have been successfully held, the sheer size of production, distribution, finishing and exportation infrastructure remains a challenge; but these are of less concern than political instability.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.