December 13th, 2011

Two interesting articles on Africa’s economic prospects.

The first, via the Economist, looks at

HER $3 billion fortune makes Oprah Winfrey the wealthiest black person in America, a position she has held for years. But she is no longer the richest black person in the world. That honour now goes to Aliko Dangote, the Nigerian cement king. Critics grumble that he is too close to the country’s soiled political class. Nonetheless his $10 billion fortune is money earned, not expropriated. The Dangote Group started as a small trading outfit in 1977. It has become a pan-African conglomerate with interests in sugar and logistics, as well as construction, and it is a real business, not a kleptocratic sham.

Legitimately self-made African billionaires are harbingers of hope. Though few in number, they are growing more common. They exemplify how far Africa has come and give reason to believe that its recent high growth rates may continue. The politics of the continent’s Mediterranean shore may have dominated headlines this year, but the new boom south of the Sahara will affect more lives.

From Ghana in the west to Mozambique in the south, Africa’s economies are consistently growing faster than those of almost any other region of the world. At least a dozen have expanded by more than 6% a year for six or more years. Ethiopia will grow by 7.5% this year, without a drop of oil to export. Once a byword for famine, it is now the world’s tenth-largest producer of livestock. Nor is its wealth monopolised by a well-connected clique. Embezzlement is still common but income distribution has improved in the past decade.

Severe income disparities persist through much of the continent; but a genuine middle class is emerging. According to Standard Bank, which operates throughout Africa, 60m African households have annual incomes greater than $3,000 at market exchange rates. By 2015, that number is expected to reach 100m—almost the same as in India now. These households belong to what might be called the consumer class. In total, 300m Africans earn more than $700 a year. That’s not much, and many of those people could be pushed back into penury by a small change in circumstance. But it can cover a phone and even some school fees. “They are not all middle class by Western standards, but nonetheless represent a vast market,” says Edward George, an economist at Ecobank, another African banking group.

As for Africans below the poverty line—the majority of the continent’s billion people—disease and hunger are still a big problem. Out of 1,000 children 118 will die before their fifth birthday. Two decades ago the figure was 165. Such progress towards the Millennium Development Goals, a series of poverty-reduction milestones set by the UN, is slow and uneven. But it is not negligible. And the mood among have-nots is better than at any time since the independence era two generations ago. True, Africans have a remarkable capacity for being upbeat. But it is seems that this time they really do have something to smile about.

Lions and tigers (and bears)

Since The Economist regrettably labelled Africa “the hopeless continent” a decade ago, a profound change has taken hold. Labour productivity has been rising. It is now growing by, on average, 2.7% a year. Trade between Africa and the rest of the world has increased by 200% since 2000. Inflation dropped from 22% in the 1990s to 8% in the past decade. Foreign debts declined by a quarter, budget deficits by two-thirds. In eight of the past ten years, according to the World Bank, sub-Saharan growth has been faster than East Asia’s (though that does include Japan).

Even after revising downward its 2012 forecast because of a slowdown in the northern hemisphere, the IMF still expects sub-Saharan Africa’s economies to expand by 5.75% next year. Several big countries are likely to hit growth rates of 10%. The World Bank—not known for boosterism—said in a report this year that “Africa could be on the brink of an economic take-off, much like China was 30 years ago and India 20 years ago,” though its officials think major poverty reduction will require higher growth than today’s—a long-term average of 7% or more.

There is another point of comparison with Asia: demography. Africa’s population is set to double, from 1 billion to 2 billion, over the next 40 years. As Africa’s population grows in size, it will also alter in shape. The median age is now 20, compared with 30 in Asia and 40 in Europe. With fertility rates dropping, that median will rise as today’s mass of young people moves into its most productive years. The ratio of people of working age to those younger and older—the dependency ratio—will improve. This “demographic dividend” was crucial to the growth of East Asian economies a generation ago. It offers a huge opportunity to Africa today.

Seen through a bullish eye, this reinforces exuberant talk of “lion economies” analogous to the Asian tigers. But there are caveats. For one thing, in Africa, perhaps even more so than in Asia, wildly different realities can exist side by side. Averaging out failed states and phenomenal success stories is of limited value. The experience of the leaders is an unreliable guide to what will become of the laggards. For another, these are early days, and there have been false dawns before. Those of bearish mind will ask whether the lions can match the tigers for stamina. Will Africa continue to rise? Or is this merely a strong upswing in a boom-bust cycle that will inevitably come tumbling back down?

More than diamond geezers

Previous African growth spurts undoubtedly owed a lot to commodity prices (see chart 1). After all, Africa has about half the world’s gold reserves and a third of its diamonds, not to mention copper, coltan and all sorts of other minerals and metals. In the 1960s revenues from mining paid for roads, palaces and skyscrapers. When markets slumped in the 1980s the money dried up. The skylines of Johannesburg, Nairobi and Lagos are still littered with high-rise flotsam from the high-water marks of previous booms.

Recently revenues from selling oil and metals have helped to fill treasuries, create jobs and feed an appetite for luxury. In gem-rich Angola, high-grade diamonds are reimported after being cut in Europe to adorn the fingers of local minerals magnates and their molls.

Overall, though, only about a third of Africa’s recent growth is due to commodities. West and southern Africa are the chief beneficiaries. Equatorial Guinea gets most of its revenues from oil; Zambia gets half its GDP from copper. When commodity prices soften or tumble such countries will undoubtedly suffer. But it is east Africa, with little oil and only a sprinkling of minerals, that boasts the fastest-expanding regional economy on the continent, and there are outposts of similar non-resource-based growth elsewhere, such as Burkina Faso. “Everything is growing, not just commodities,” says Mo Ibrahim, a Sudanese mobile-phone mogul who is arguably Africa’s most successful entrepreneur.

When the world economy—and with it commodity prices—tanked in 2008, African growth rates barely budged. “Africa has great resilience,” says Mthuli Ncube, chief economist of the African Development Bank. “A structural change has taken place.”

A long-term decline in commodity prices would undoubtedly hurt. But commodity-led growth on the continent is not as reversible as it used to be. For one thing, African governments have invested more wisely this time round, notably in infrastructure. In much of the continent roads are still dire. But there are more decent ones than there used to be, and each new length of tarmac will boost the productivity of the people it serves long after the cashflow that paid for it dries up. For another, Africa’s commodities now have a wider range of buyers. A generation ago Brazil, Russia, India and China accounted for just 1% of African trade. Today they make up 20%, and by 2030 the rate is expected to be 50%. If China and India continue to grow Africa probably will too.

More jaw-jaw, less war-war

What’s more, many foreign participants in the African commodity trade have become less short-termist. They are likely to stick around after they finish mining; Chinese workers, of whom there are tens of thousands in Africa, have shown a propensity to morph into local entrepreneurs. A Cantonese construction company in Angola recently set up its own manufacturing arm to produce equipment that is difficult to import. Few Western competitors would do the same (though many of their colonial forebears did).

Commodity growth may be more assured than it used to be. But two big drivers of Africa’s growth would still be there even if the continent held not a barrel of oil nor an ounce of gold. One is the application of technology. Mobile phones have penetrated deep into the bush. More than 600m Africans have one; perhaps 10% of those have access to mobile-internet services. The phones make boons like savings accounts and information on crop prices ever more available.

Technology is also aiding health care. The World Bank says malaria takes $12 billion out of Africa’s GDP every year. But thanks to more and better bed nets, death rates have fallen by 20%. Foreign investors in countries with high HIV-infection rates complain about expensively trained workers dying in their 30s and 40s, but the incidence of new infection is dropping in much of the continent, and many more people are receiving effective treatment.

The second big non-commodity driver is political stability. The Africa of a generation ago was a sad place. The blight of apartheid isolated its largest economy, South Africa. Only seven out of more than 50 countries held frequent elections. America and the Soviet Union conducted proxy wars. Capital was scarce and macroeconomic management erratic. Lives were cut short by bullets and machetes.

Africa is still not entirely peaceful and democratic. But it has made huge strides. The dead hand of the Soviet Union is gone; countries such as Mozambique and Ethiopia have given up on Marxism. The dictators, such as Congo’s leopard-skin-fez-wearing Mobutu Sese Seko, that superpowers once propped up have fallen. Civil wars like the one which crippled Angola have mostly ended. Two out of three African countries now hold elections, though they are not always free and fair. Congo held one on November 28th.

Friends and neighbours

Even if many of the world’s most inept states can still be found between the Sahara and Kalahari deserts, governance has improved markedly in many places. Regulatory reforms have partially unshackled markets. A string of privatisations (more than 100 in Nigeria alone) has reduced the role of the state in many countries. In Nigeria, Africa’s biggest resource economy, the much-expanded service sector, if taken together with agriculture, now almost matches oil output.

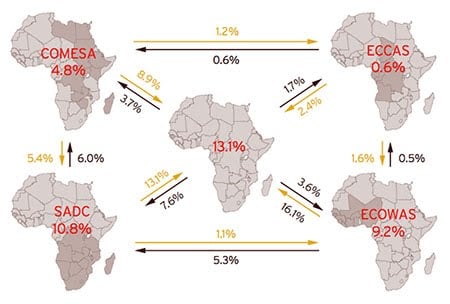

Trade barriers have been reduced, at least a bit, and despite the dearth of good roads, regional trade—long an African weakness—is picking up. By some measures, intra-African trade has gone from 6% to 13% of the total volume. Some economists think the post-apartheid reintegration of South Africa on its own has provided an extra 1% in annual GDP growth for the continent, and will continue to do so for some time. It is now the biggest source of foreign investment for other countries south of the Sahara.

Somewhat belatedly, Africans are taking an interest in each other. Flight connections are improving, even if an Arab city, Dubai, is still the best hub for African travellers. Blocks of African economies have taken steps towards integration. The East African Community, which launched a common market in 2010, is doing well; the Economic Community of West African States less so. The Southern African Development Community has made the movement of goods and people across borders much easier. That said, barriers remain, and the economy suffers as a result. Africans pay twice as much for washing powder as consumers in Asia, where trade and transport are easier and cheaper.

As in Asia a generation ago, relatively small increases in capital can produce large productivity gains. When, after decades of capital starvation, outside investors started to take that disproportionate return seriously, they helped Asia blossom. Now some of those investors are eyeing Africa. In financial centres such as London barely a week goes by without an Africa investor conference. Private-equity firms that a decade ago barely knew sub-Saharan Africa existed raised $1.5 billion for projects on the continent last year. In 2010 total foreign direct investment was more than $55 billion—five times what it was a decade earlier, and much more than Africa receives in aid (see chart 2).

Foreign investors are no longer just interested in oil wells and mines. They are moving on to medium-sized bets on consumer goods. The number of projects—for example by retail chains such as Britain’s Marks & Spencer—has doubled in the past three years. Despite the boom in mining, the share of total investment going into extractive activities has shrunk by 13%. That said, the riches are far from evenly spread: three-quarters of all investments are in just ten big countries.

The increased interest from outsiders that has been triggered by Africa’s political and technological changes is not, though, the heart of the story. Economic change has made life more rewarding for Africans themselves. They have more opportunities to start businesses and get ahead than they have enjoyed in living memory, and governments are showing some willingness to get out of their way. According to the World Bank’s annual ranking of commercial practices, 36 out of 46 African governments made things easier for business in the past year.

Talking to the future

No end to worries

That said, most African countries are still clustered near the bottom of the table. In all sorts of ways African governments need to run their countries more efficiently, more accountably and less intrusively. They also need to offer much better schooling, an area in which Africa woefully lags behind Asia. African businessmen constantly complain about the shortage of skills. Hiring qualified staff can be prohibitively expensive. The return of skilled exiles has helped in some newly peaceful countries, but often foreigners are needed, usually other Africans. Without better education, Africa cannot hope to emulate the Asian miracle.

Africa’s demographic dividend, too, is far from guaranteed. A growing population and a bulge of working-age citizens proved a blessing in Asia. But population growth always has its costs. All those extra people must be fed, educated and given opportunities. If illiberal policies obstruct growth and discourage firms from hiring, Africa’s extra millions may soon be jobless and disgruntled. Some may even take up arms—a sure recipe for disaster, both human and economic.

An abundance of young people is like gearing on a balance sheet: it makes good situations better and bad ones worse. It is worrying that some of Africa’s fastest-growing populations are in economies not performing well at the moment; and fertility rates are not declining as uniformly, or as swiftly, as they did in Asia.

Africa’s extra people are flocking to cities. Some 40% of Africans are city dwellers now, up from 30% a generation ago. By 2025 the number is likely to be 50%. In Asia the rate is currently 52%. This is usually a good thing. Productivity is higher in cities. Transport costs are lower and markets are busier when people live close to each other. In bad times, the tight ethnic jumble of the city can be a powder keg. That said, Africa’s worst wars, such as those in Congo, Rwanda, Sudan and Somalia, have been fought in countries where most people are peasants or livestock herders.

Extra mouths will need to be fed. There is scope for this. Though Africa is now a net food importer, it has 60% of the world’s uncultivated arable land. It produces less per person now than in 1960. Africa’s land is often hard to farm, with large year on year variations in climate (a problem likely to get worse as the Earth heats up). Farmers lack access to capital for fertiliser and irrigation. More roads and storage depots are also needed; much of the harvest rots before it gets to market. And land ownership often raises thorny issues about who belongs to a place and who does not.

Agriculture is a long-term worry. A shorter term concern is how to deal with a coming slowdown and recession in the north. Investors fleeing risky assets in Europe are unlikely to put their cash into Africa. More likely they will pull back some of the money they have already invested there. The signs are that this is already happening. Bankers say the deal flow is slowing. But many remain generally bullish on Africa, convinced that its growth potential will reward patient investors and eventually lure back fickle ones.

Africa’s growth is now underpinned by a permanent shift in expectations. In many African countries people have at last started to see themselves as citizens, with the rights that citizenship brings. Greater political awareness makes it harder for incompetent despots to hold on to power, as north Africa has discovered. Bastions of the continent’s past—destitute, violent and isolated—are becoming exceptions.

Africa is not the next China. It provides only a tiny fraction of world output—2.5% at purchasing-power parity. It is as yet not even a good bet for retail investors, given the dearth of stockmarkets. Mr Dangote’s $10 billion undeniably makes him a big fish, but the Dangote Group accounts for a quarter of Nigeria’s stockmarket by value: it is a small and rather illiquid pond. Nonetheless, Africa’s boom will continue to benefit Africans, serving the billion as well as the billionaires. That is no small feat.

The second, via Foreign Policy, looks at intra-African trade and the need for further regional economic integration:

Africa’s economic prospects have always been a topic of great consternations for local governments and international analysts and commentators. A continent rich in commodities (oil, diamonds, minerals), with a favorable demographic trends, and the potential for economic growth, has historically been ‘stuck in the muck’. Yet, things are turning around, and the past decade has seen consistent economic growth (faster than East Asia’s), a 200% increase in trade with the rest of the world, a decline in foreign debt (by a quarter) and budget deficits (by two thirds), and inflation in the single digits (8%).

Although there still a lot to be done throughout the continent, a recent article by The Economist (Africa’s hopeful economies: The sun shines bright) was talking about the emergence of Africa’s “Lion Economies.” However, the global financial crisis which, has crippled the U.S. and EU economies and is threatening global trade and commodity prices, could also derail Africa’s economic prospects and its significant progress to sustainable growth.

With this in mind, in January 2012, the African Union Heads of State and Government will hold their annual summit and focus on the theme of “Boosting Intra-Africa Trade”. The choice of the theme is both appropriate and timely, given the challenges facing the continents ability to continue to rely on global trade and high commodity prices for growth, and the need to come up with strategies to improve the situation.

On average over the past decade, only about 10 – 13% of African trade is with African nations, whilst 40% of North American trade is with other North American countries, and 63% of trade by countries in Western Europe is with other Western European nations.

To this end, African countries have established the African Union, and created various Regional Economic Communities (RECs) to improve growth through trade. In this context, the RECs are pursuing integration through free trade, and developing customs unions and a common market. Eventually, these efforts are expected to converge to an African Common Market (ACM) and an African Economic Community (AEC), whereby economic, fiscal, social and sectoral policies will be continentally uniform.

Pooling economies and markets together through regional integration provides a sufficiently wide economic and market space to make economies of scale possible. Trade enables countries to specialize and export goods that they can produce cheaply, in exchange for what others can provide at a lower cost. Trade also provides the material means in terms of capital goods, machinery and raw and semi-finished goods that are critical for growth.

More importantly, through such an economic marketplace, Africa can strengthen its economic independence and empowerment with respect to the rest of the world. A united Africa can better negotiate for access to markets (foreign and domestic), commodity prices, foreign investment and technology transfers with its trading partners in the U.S. and the EU.

Even more importantly, is the ability to negotiate better terms of trade with the BRIC countries, which operate more nationalistically in the global market then the U.S.-EU market economies (negotiating with governments vs. negotiating with corporations). A generation ago, Brazil, Russia, India and China accounted for just 1% of African trade. Today they make up 20%, and by 2030 the rate is expected to be 50%. Therefore, as the BRIC economies go, so will Africa’s economic prosperity – thus enhancing the negotiating needs of the continent vis-à-vis the BRIC countries.

A New Continental FTA –

Therefore, if trade is a vehicle to growth and development, then removing the barriers that inhibit it can only help increase its impact. In order to address this trend, African leaders are making new commitments to boosting intra-African trade.

First was the landmark decision by COMESA, EAC (East Africa Community – Burundi, Kenya, Rwanda, Tanzania, and Uganda) and SADC to establish a single Free Trade Area. The launch of this tripartite FTA initiative covering 26 African countries (more than half of AU membership) with a combined population of 530 million (57% of Africa’s population) and a total GDP of $630 billion (53% of Africa’s total GDP) has galvanized interest towards a much broader Continental FTA.

It will enlarge markets for goods and services, eliminate the problem of multiple and overlapping memberships, enhance customs cooperation and broader trade facilitation, promote harmonization and coordination of trade instruments and nomenclature, and broader relaxation of restrictions on movement of goods, persons and services.

The collaboration and cooperation of RECs through the Continental FTA should further improve regional infrastructure and consolidate regional markets through improved interconnectivity in all forms of transport and communication as well as promote energy pooling to enhance the regions’ competitiveness.

Export-led Growth Alternatives –

The one lesson from South-East Asia that all developing countries and regions must never forget is that export-led growth will always produce desirable economic benefits. Focusing on existing areas where the continent has a comparative advantage (fuels, minerals, and even food products) will continue to generate valuable returns to be invested in those areas that need additional financing.

Food production in particular (along with beverages, tobacco, and other agricultural products) could be a boondoggle for African countries. Although the continent as a whole is a food importer (see chart from a recent Issue Paper prepared by the AU Commission for the 2012 AU Summit), Africa has 60% of the world’s uncultivated arable land. With rising populations in Asia, food is becoming more and more valuable, and global food prices and constantly rising. Africa more than Europe is in need of ‘Common Agricultural Policy’ which puts real focus and energy (meaning financing) behind this potentially very profitable segment of the economy.

However, as the Commissions Issue Paper points out, the continents infrastructure and logistic shortcomings make all efforts to increase trade (export or intra-African) very expensive and uncompetitive. In particular, because of infrastructure bottleneck (roads, ports, telecommunications, and storage) transport costs are 63% higher in African countries compared with the average in developed countries (and constitute 14% of the value exported in African countries, against 8.6% in developed countries).

Furthermore, delays at African customs are, on average, longer than in the rest of the world: 12 days in Sub-Saharan countries compared with 7 days in Latin America, less than 6 days in Central and East Asia, and slightly more than 4 days in Central and East Europe. These delays add a tremendous cost to importers and exporters, and they increase the transaction costs of trading among African countries. Each transport day lost due to customs and related problems are equivalent to additional tax. In addition, delays and complicated procedures related to insuring goods and customs guarantee requirements raise the cost of exporting from Africa and compromise the continent’s competitiveness. For food and agricultural (perishable) goods, such delays can be devastating – leading to the complete loss of entire shipments.

The Road Ahead –

For Africa, it often seems that the obstacles outweigh the potential for sustainable poverty alleviation and continuing economic growth. The current situation is hanging in the balance, especially after the global financial crisis and the recent political upheaval in the north (see Arab Spring).

But, incrementally, it appears that the leaders of the African Union are fully aware of the way forward; a Continental FTA that focuses on Intra-African trade. The road (for regional integration) is long and hard, but if the AU can ‘build it’ then goods will come and go, and trade could do for Africa what it has done for South and East Asia.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.