November 29th, 2011

Courtesy of The Financial Times, a report on the growth and investment returns of the BRICs as they cross the age of 10:

So, was he right? Ten years ago Jim O’Neill of Goldman Sachs looked at four growth economies – Brazil, China, India and Russia – put their first letters into an acronym, and the Brics (as a concept) were born.

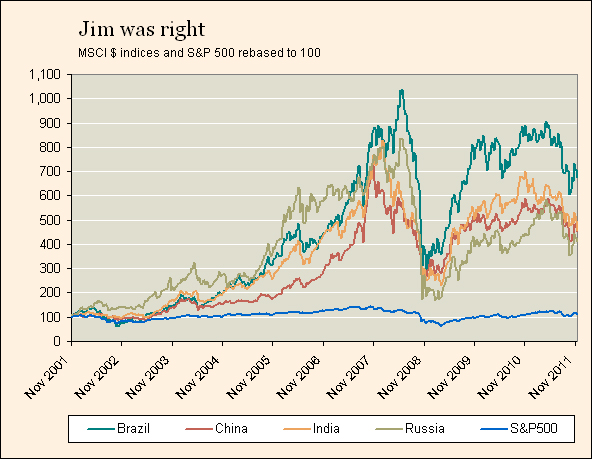

So how have they fared? What if you invested in the Brics ten years ago – where would you be now? Chart of the week finds out.

There are a myriad of ways of looking at this, but beyondbrics is going to be hard-headed and stick to equities and GDP.

A quick look at the MSCI indices for the four Brics since 2001 shows that they have comfortably outperformed the S&P 500. If you invested $100 at the time of O’Neill’s report in November 2001 in each of the four Brics, you would now have $674 from Brazil, $451 from China, $459 from India and $414 from Russia. Your 100 S&P bucks? Worth $112.

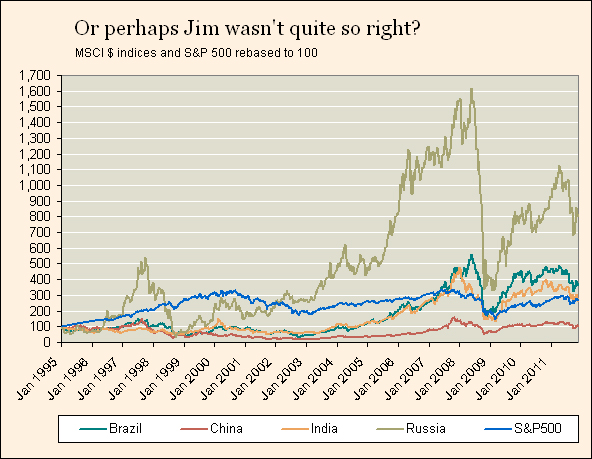

But let’s play devil’s advocate for a minute, and go back, to 1995, for example. Where do our five $100 bills get us?

Well, the best bet would have been Russia – despite two massive crashes that wiped off over 79 per cent of the MSCI value, $100 dollars in 1995 would now have become $800 now. Brazil and India would have given you an acceptable return of $363 and $263 respectively.

But China has barely scraped into positive territory: our $100 has earned just 48 cents. And the S&P is up to $265. Not such a clear-cut picture. Was O’Neill lucky in his timing?

But equities aren’t the only indicator – or even the main one from the point of view of overall economic development.

The Bric countries have seen great GDP growth – China’s economy has risen from around $1,000bn in 2001 to over $6,000bn today. Aside from Russia in 2008-09, all of the Brics have avoided recession in the last ten years.

So have the markets and GDP risen in step? Not really. The rise in equities from 2001-11 has outpaced GDP growth in India and Brazil – giving investors a better return. But in the same period Russian and Chinese GDP growth have comfortably exceeded the markets – in China’s case, because many of the state-run enterprises that dominate the economy have different priorities, other than boosting return on equity.

In Russia, valuations are overshadowed by investors’ concerns about corruption, transparency and state intervention in the economy. Many fund managers were disgusted by the Yukos affair – the oil group that was broken up when its founder, Mikhail Khodorkovsky, was convicted of fraud. The portfolio investors were among those who lost out.

2001 to 2011 1995 to 2011 MSCI vs GDP * MSCI vs S&P500 ** MSCI vs GDP * MSCI vs S&P500 ** China -76.2 339.5 -859.5 -163.4 India 81.3 347.4 -241.4 -0.3 Brazil 218.4 562.1 36.4 99.7 Russia -200.9 302.1 198.4 535.8

* percentage increase in GDP – percentage increase in MSCI

** percentage increase in MSCI – percentage increase in S&P500The change in equities vs GDP is even clearer for China when we look at the 1995-2011 period. Over that time, GDP has grown from $728bn to around $6,988bn – a rise of over 800 per cent, compared to the relatively flat markets over the same period. India too has had a significant increase in GDP over equities over the last 16 years, with GDP rising from $365bn to $1,843bn, a rise of over 400 per cent, with equities going up 163 per cent.

The upshot? O’Neill’s choice of the BRICs was inspired. His timing even more so

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.