January 27th, 2023

Via Geopolitical Futures, commentary on China’s interest and role in Afghanistan:

The foreign ministers of China and Afghanistan spoke for nearly an hour on Jan. 22 about Afghanistan’s economic development and ensuring the security of Chinese personnel involved in Afghan projects. This followed the signing on Jan. 5 of an oil extraction agreement between China’s Xinjiang Central Asia Petroleum and Gas Co. and the Afghan Taliban government. It was a surprising turnaround, considering that just weeks earlier – following a Dec. 12 terrorist attack in Kabul that injured five Chinese nationals – Beijing was advising its citizens to leave the country. The Chinese government, like most countries, does not even formally recognize the Afghan Taliban administration. However, Afghanistan’s geography and the allure of its natural resources are too much for China to ignore.

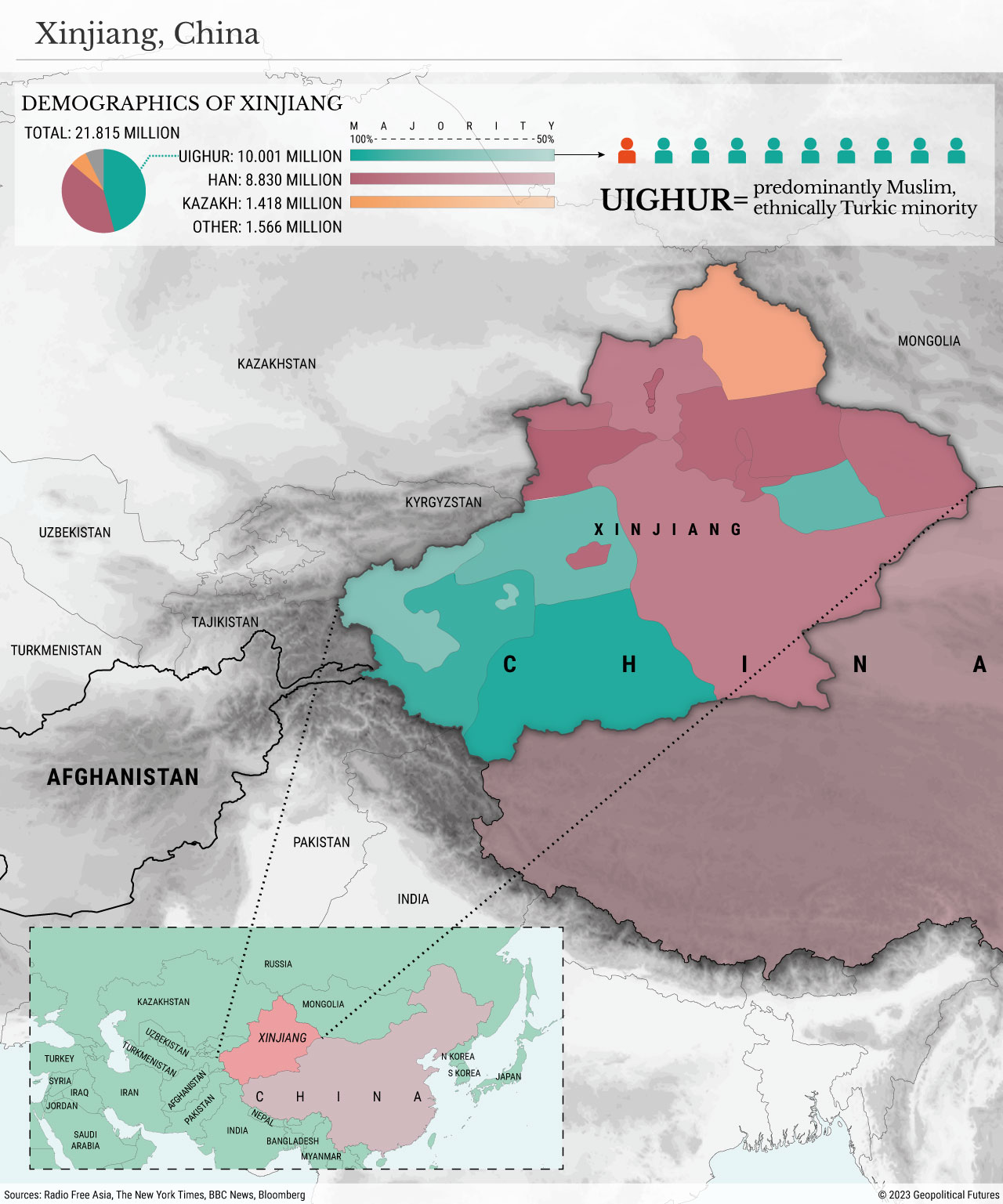

China, as well as regional countries like India and Pakistan, views Afghanistan differently from how the U.S. sees it because of its geographic proximity and strategic interests. Afghanistan borders Kashmir, a disputed region among the three countries. For China, moreover, a stable Afghanistan could provide a gateway to greater influence in Central Asia and serve as a buffer against the spread of extremism into China’s Uighur regions near the border. Afghanistan is also believed to be rich in rare earth minerals such as lanthanum, cerium and neodymium, as well as valuable metals such as aluminum, gold, silver, zinc, mercury and lithium. China dominates the global production and supply of rare earth minerals critical for renewable energy and defense, and it’s seeking to secure its position in the market. In light of increased competition from other nations looking to secure their own supplies and reduce dependency on China, Beijing sees developing relations with Afghanistan as a key step toward maintaining its long-term dominance in the rare earth mineral market.

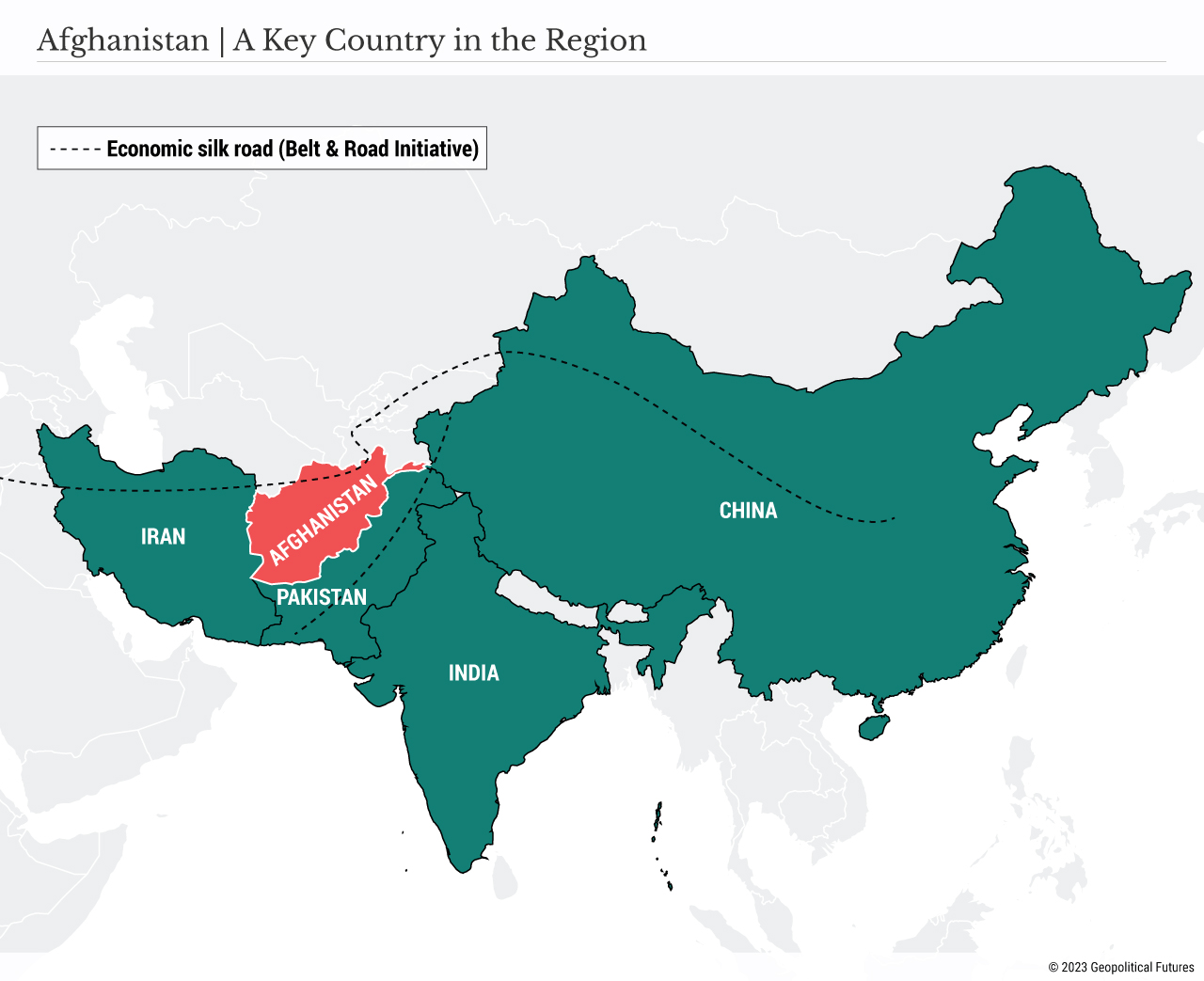

Afghanistan is also key to China’s development of its Belt and Road plans. Instability in Afghanistan challenges the development of the China-Pakistan Economic Corridor, which will give China access to the Arabian Sea via Pakistan. Pakistan wants to ensure its mostly Pashtun west is calm. India, fearing that Pakistan will gain control of Afghanistan and use it to expand, has attempted to help Iran create more infrastructure links with Afghanistan. For its part, Iran needs investment to shore up its economy, and it wants to prevent the growth of an insurgency next door. China and Iran have also long discussed opportunities for Iran to become a partner in the Belt and Road Initiative. However, domestic difficulties restrict the ability of Pakistan and Iran to influence Kabul.

Afghanistan, however, remains the most fragile state of the region – socially, economically and politically. This is why the oil development project is also significant for Kabul. It is the first extraction agreement the Taliban have signed with a foreign entity since retaking control of the country in 2021. For China to put enough trust in the Taliban regime to justify such an investment is no small thing. But although China appears to be in the lead, several regional countries are competing with it for influence in Afghanistan, and the price of stabilizing the South Asian country tends to be higher than would-be patrons expect going in.

Since the U.S. withdrawal from Afghanistan in 2021, the Taliban government has dealt with two major problems. First, although overall violence has decreased, the Islamic State emerged as a major security threat. Second, the economy depends on foreign aid. The West and the United Nations sanctioned the Taliban after they ousted the U.S.-backed administration, freezing $9.5 billion of Afghan assets. Sanctions relief for humanitarian purposes did little to help the impoverished country. According to Gallup polls, nine in 10 Afghans say they are finding it “difficult” or “very difficult” to get by on their current household income. Remnants of the long war like land mines continue to hinder a return to normalcy.

China is best positioned to take advantage of the void left by the U.S. withdrawal. During the 1990s, Beijing engaged the Taliban and managed to stop militant infiltration into western China. As the Taliban were retaking the capital in August 2021, drawing widespread condemnation, Beijing encouraged them to execute a smooth transition and limit terrorism and crime. Despite its principle of non-interference, Beijing has only increased its influence in Afghanistan since then, providing aid and hosting multilateral meetings with the purpose of engaging the Taliban. It has encouraged Chinese businesses to build inroads in the country. In 2022, a Chinese steel plant started work in the country, and Kabul approved a joint project with Beijing to develop a $216 million industrial park project to host up to 150 factories on the capital’s outskirts. But in spite of its efforts, Afghans’ perceptions of China’s leadership are deteriorating along with those of the U.S. and Russia.

Three factors will limit China’s ability to fully exploit the opportunity presented by the U.S. departure. First, China’s socio-economic problems are eating away at its ability to invest in the Belt and Road. Second, although Afghanistan’s economic opportunities are significant, so is its political uncertainty. Finally, and perhaps most important, Afghanistan is critical to a new Eurasian great game in the making. Like the war in Ukraine and the global economic war, what happens in Afghanistan will shape the power balance among the major players – but perhaps not in the ways one might expect. If Afghan history has any lessons for foreign powers, it is that the country that invests the most in trying to control it always loses in the end.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.