Ivory Coast’s eurobonds rallied after the nation’s credit score was lifted by Moody’s Investors Service, which cited the resilience of the economy and rising private sector investments.

The company raised the West African nation’s rating one level to Ba2, two levels below investment grade over the weekend. The upgrade helps Ivory Coast join South Africa as the highest rated sovereign in sub-Saharan Africa with foreign debt outstanding. The outlook was moved to stable from positive.

Yields on all of Ivory Coast’s dollar bonds were falling Monday. The yield on debt maturing in 2028 declined 15 basis points to 7.20%, notching the biggest one-day drop since Jan. 19 and taking it to the lowest level in nearly a month. The improvement continues a trend of falling yields on the dollar debt of the world’s largest cocoa producer, with its notes due 2033 down around 239 basis points since reaching record highs in April 2022.

Ivory Coast “is today one of the most attractive countries on the continent which continues to show robust long-term prospects,” the Finance Ministry said in a statement following the ratings announcement.

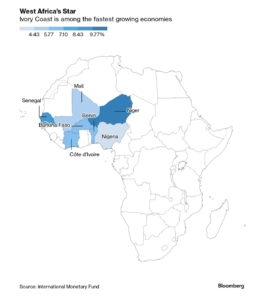

Moody’s forecasts the $70 billion economy will expand 7% until 2026 led by private sector investment. Foreign direct investment into the nation rose 15% in 2022 while neighboring Nigeria saw an outflow.

The upgrade comes amid “increasing resilience and diversification of Ivory Coast’s economy, which is underpinned by robust growth prospects and rising competitiveness,” analyst Elisa Parisi-Capone wrote.

The credit assessor also touted to fiscal consolidation efforts under the current program with the International Monetary Fund as well as the government’s debt management. The nation sold its first dollar bond in almost seven years in January.

Fitch Ratings and S&P Global Ratings score the country a notch lower than Moody’s and assign it a stable outlook.

‘Well Received’

“Strengthening in the bonds since the announcement points to the fact that it has been well received by the market,” said Thalia Petousis, a portfolio manager at Allan Gray.

Ivory Coast’s sovereign eurobonds are one of the largest positions in the Allan Gray Africa Bond Fund she said. The appeal came from high growth over several years, with a strong track record of private-sector led growth, job creation, and good capital investments.

The nation also benefits from low CFA Franc in-country borrowing yields said Petousis, and was “defacto guaranteed by France” which has been a stabilizing factor in terms of national inflation.

“Ivory Coast has a manageable debt burden of of about 56% GDP and a lengthy debt maturity profile, as well as lower interest costs as a percentage of tax revenue compared to South Africa,” she said. “On this basis, the Moody’s upgrade is not a surprise to us.”

Cote d’Ivoire: West Africa’s Star

March 6th, 2024

March 6th, 2024

Via BNN Bloomberg, a report on Cote d’Ivoire:

This entry was posted on Wednesday, March 6th, 2024 at 2:04 am and is filed under Cote d'Ivoire. You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.

ABOUT

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.