April 18th, 2014

Via the Asian Development Bank, a look at how Mongolia could boost its economy through careful regional integration:

Regional integration offers Mongolia the opportunity for a more prosperous future. But the country has lagged in this effort, which is surprising given its geographical location where bold integration initiatives have been launched, such as the People’s Republic of China’s (PRC) “Silk Road Initiative,” and where economic alliances have been strengthened under Central Asia Regional Economic Cooperation (CAREC) and Shanghai Organisation for Cooperation (SCO).

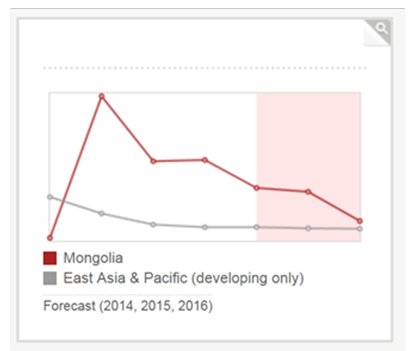

Comparative GDP growth, 1990-2016

Source: World Economic Outlook Database, October 2013. 2012-2016 figures are IMF estimates.

Mongolia faces great economic challenges. It is dependent on the PRC and Russia because of its close economic ties and geographical “sandwich location” between its two giant neighbors. Additionally, Mongolia has experienced volatile growth due to falling global commodity prices and controversies with foreign investors. The Mongolian economy has therefore not developed as well as expected—a trend that can be redirected to a positive direction via sound regional integration.

Annual GDP Growth (%)

Source: World Bank

The EU, as the global frontrunner for regional integration, and the highly successful ASEAN demonstrate that regional integration promotes growth, wealth, and development—it increases mutual market access, supports industry and energy production, and opens new finance and investment sources.

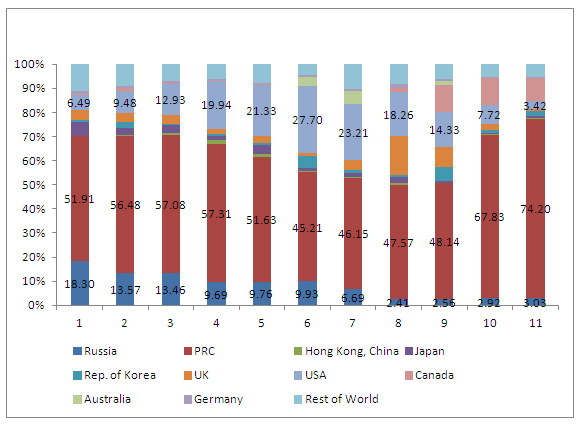

Mongolia’s Export Partners, 1997-2007

Source: UN COMTRADE

Mongolia has great integration potential. Its landlocked “sandwich location” should not be seen as a disadvantage, but as an opportunity. Mongolia needs export markets for its mineral resources. While there is interest in these mineral resources among EU and US companies, far more promising markets are just around the corner with ASEAN, the PRC, Japan, and the Republic of Korea (henceforth, Korea)—all belonging to an East Asia region that boasts a greater dynamic growth outlook than the EU or the US.

Furthermore, Mongolia has the option to diversify an economy heavily dependent on mineral exports by developing its agricultural sector, especially livestock and dairy farming. The PRC, Japan, and Korea offer vast markets for these agricultural products provided that Mongolia’s farmers upgrade to an international level their veterinarian and sanitary standards as well as logistics and infrastructure.

Mega markets in East Asia

But whatever the industry, Mongolia’s producers face the limits of a small domestic market of only three million potential consumers. Opportunities for market expansion will only partially be found in faraway EU and US markets, so Mongolia must look to the much closer mega markets in East Asia.

Even though tariffs on several commodities in the trade between Mongolia and other East Asian countries are relatively low, deeper regional integration via free trade agreements (FTAs) could lead to further tariff cuts and a lifting of non-tariff trade barriers. But Mongolia is the only WTO member country without a single FTA—an astonishing phenomenon, particularly in East Asia with its thickening “noodle bowl” of FTAs.

Another key aspect for regional integration is Mongolia’s geographical position in the heart of Northeast Asia separating the Russian providers of energy and mineral resources from the PRC’s industrial and private consumer market (the PRC is Russia’s most important trade partner). Mongolia’s huge landmass also divides the PRC’s industrialized provinces in the northeast from the less developed regions in the northwest. Most Russian–PRC trade transits Mongolia, at least to the limits set by the poor Mongolian railway and road infrastructure. But taking visions such as the Silk Road Initiative into consideration, there is great potential for Mongolia’s economy if it can upgrade its infrastructure into a central East Asian traffic and pipeline junction for trade and transport from north to south and from east to west. Mongolia lacks the financial resources for such a comprehensive modernization and expansion of its infrastructure. But in view of the immense investment powers next door, especially in the PRC, Japan, Korea, and Russia, a regional integration initiative on transport and energy infrastructure could attract investors and financial resources.

This leads to the conclusion that regional integration could provide Mongolia with the opportunity for a prosperous future. But the answer to the question of how to realize that regional integration is a complex one.

Here are the options:

First, Mongolia has the opportunity to build a network of FTAs among its key trade partners. But this is not advisable because Mongolia’s small economy would put it at a disadvantage when negotiating a trade deal with more powerful economies, such as the PRC, Japan, or Korea.

Second, Mongolia could make more use of existing regional integration arrangements like CAREC or SCO, but its cautious stance on these two integration approaches is influenced by its concerns over the democracy deficits among CAREC and SCO member states, as well as by the dominance of “big neighbor” PRC in these alliances. Also, the CAREC and SCO integration results and the cooperation drive have been rather limited and disappointing in terms of economic integration.

Third, Mongolian officials are optimistic on their country’s perspective concerning the Asian Pacific Economic Cooperation (APEC) or Trans Pacific Partnership (TPP). But when analyzing their expectations soberly one has to recognize that, apart from TPP, which is in an open-ended negotiation process with many imponderabilities, even the equally ambitious APEC alliance has not been able to create tangible integration results among its member countries. Furthermore, from Mongolia’s perspective, the TPP excludes Mongolia’s key trade partners, the PRC, Korea, and Russia—and that Mongolia’s membership would not be an “automatism” because it lacks the criterion of access to the Pacific Ocean and has a rather low development level compared with other APEC and TPP countries.

Fourth, creating a Northeast Asia Free Trade Association (NEAFTA) is high on political agendas—although the NEAFTA seems to be interpreted in different variations: the NEAFTA model of Japan, Korea, US versus the NEAFTA model of Japan, Korea, PRC versus a comprehensive NEAFTA model proposed by the PRC with the PRC, Japan, both Koreas, Mongolia, and Russia. The first two NEAFTA models have in common that they contain only powerful and heavily industrialized economies where relatively low developed Mongolia, with its narrowly focused economy of minimal industry and a small market, would not fit in. Apart from that, the first model excludes the PRC, Mongolia’s biggest trade partner whereas the second model is burdened with multidimensional controversial interests and with complex historical and territorial disputes, which form challenging obstacles for a speedy and successful realization.

Fifth, ASEAN is the most successful regional integration effort in Asia and among developing countries. ASEAN is planning to install a common market with the ASEAN Economic Community by 2015 for the free exchange of goods, services, investments, capital, and to a certain extent, labor. ASEAN has created an advanced financial integration scheme in form of a common surveillance mechanism and a comprehensive currency swap arrangement including a capacious reserves pool, the Chiang Mai Initiative Multilateralization, to function as a shield against liquidity shortage risks. All this has happened with the close participation of the PRC, Japan, and Korea under the ASEAN+3 scheme connecting the 10 ASEAN members in different economic, financial, and infrastructure dimensions to Asia’s “big three.” ASEAN+3 is on the way to building the biggest free trade area in the world. This powerful trade association could become the regional key organization for economic integration in East Asia and beyond.

ASEAN+3 has not only gained merits as an effective catalyst for regional economic integration, it could also be further developed to contribute to regional dispute settlements in an East Asia region beset with unsolved territorial claims. For Mongolia this may become relevant as it considers itself usually at a disadvantage in disputes with its two big neighbors, especially the PRC. One does not have to be over-optimistic to expect ASEAN+3 to develop a dispute settlement mechanism not too far in the future that would provide less powerful countries like Mongolia with an effective instrument to defend their territorial or other interests against larger neighbors. Preliminary signals have emerged of a growing solidarity among ASEAN members on the issue of territorial disputes, for instance in support of the Philippines versus the PRC. The ASEAN Charter adopted in 2007 is explicit on this issue and gives a catalog of rules for regional dispute settlement and even announces the establishment of appropriate dispute settlement mechanisms where they are not yet provided. A proper use of these rules within ASEAN could build a promising bridge for expanding them to an effective ASEAN+3 dispute settlement mechanism.

All these points offer convincing arguments that ASEAN+3 could be the optimal “docking station” for Mongolia’s regional integration. However, Mongolia is not part of Southeast Asia, which is a requirement under the ASEAN Charter. One option would be to link Mongolia as a fourth East Asian country so that ASEAN+3 would become ASEAN+4.

Conclusion

Despite many development obstacles, Mongolia has a chance for economic success. Apart from working on its domestic development deficits, Mongolia will only be able to realize this opportunity via a goal-oriented, regional economic integration with East Asia where the ASEAN+4 model is the only promising option. Otherwise Mongolia runs the risk of falling behind as an underdeveloped and isolated “white spot” on East Asia’s dynamically advancing economic integration map.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.