More than 50 ships queued to cross the Panama Canal on a recent day—from tankers hauling propane to cargo ships packed with food. A prolonged drought has led the canal’s operator to cut the number of crossings, resulting in longer waits. The tolls that ships pay are now around eight times more expensive than normal.

Over 7,000 miles away, vessels that move containers through Egypt’s Suez Canal are waiting for naval escorts or avoiding the passage altogether to take a much longer voyage around South Africa. Ship operators fear that their crews could be imperiled on the journeys through the Red Sea by missile or drone attacks from a Yemen-based rebel group.

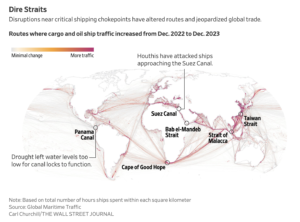

The Suez’s problems are geopolitical and those in Panama are climate-based, but both are roiling global trade. Cargo volumes through the Suez and Panama canals have plunged by more than a third. Hundreds of vessels have diverted to longer routes, resulting in delivery delays, higher transportation costs and economic wreckage for local communities.

Ship operators are bracing for months of uncertainty in the waterways where some 18% of global trade volumes crossed last year.

The Panama Canal is in the midst of one of the driest periods in the artificial waterway’s century of operation. Officials hope the drought, which started in mid-2023, will let up at the end of the dry season in May.

In the Suez?, some ship operators have indefinitely suspended voyages because of strikes on commercial vessels further south. Houthis have attacked more than 50 ships since November?, including a cargo vessel loaded with fertilizer? that sank into the Red Sea and another that resulted in three deaths.

Retaliatory strikes by an American-led coalition have destroyed roughly a third of Houthi military assets, according to a Pentagon official.

“It’s the first time that both are disrupted simultaneously so you have to plan way in advance where to send your ship and you pay a hell of a lot more regardless,” said Tim Hansen, chief operations officer of Stamford, Conn.-based Dorian LPG, which operates a fleet of 25 ships that move propane and butane.

The problems haven’t had a huge impact on consumers yet, but businesses are starting to feel the ripples. Tesla and Volvo paused vehicle production for up to two weeks in January because of parts shortages.

Some apparel companies opted for their spring fashions to be delivered by air instead of sea to ensure items arrived on time.

For now, the interruptions to supply chains are on a modest scale compared with the more widespread bottlenecks seen in 2020 and 2021.

Back then, shippers passed along the higher costs on ocean freight to consumers, contributing to inflation on a range of consumer goods. Daily freight rates on some routes between Asia and the U.S. surged to more than $20,000 per box, roughly five times higher than current levels.

Businesses have also learned lessons from supply chaos during the pandemic, and some have built up bigger inventories to avoid running out of products.

Suez disruptions have lengthened average sailing times by about 10 days, but consumers haven’t been affected, said Jesper Brodin, CEO of Ingka Group, the company that operates most of the world’s IKEA stores.

“The huge difference is that we have recuperated after the pandemic,” he said in January at the World Economic Forum in Davos, Switzerland. “So that means our stocks in our warehouse are in good shape.”

But as more businesses return to pre-Covid practices of keeping minimal inventories and rely on timely deliveries, they are more vulnerable to disruptions if bottlenecks at the two canals continue.

“It is a watershed moment for consumers because they have been accustomed to globalization,” said Peter Sand, chief analyst at Norway-based shipping platform Xeneta. “They have been getting goods from everywhere at any given time, so it’s paramount to safeguard maritime supply chains.”

Less water

The problems meant Connecticut-based Dorian changed the calculus for its ships late last year—twice.

The Panama Canal offers the shortest route for Dorian’s ships setting sail from the Gulf of Mexico to make deliveries to clients in China, Japan and South Korea. The westbound trip, through the canal and then across the Pacific, takes roughly 25 days, compared with 40 going east through the Suez.

Some 14% of seaborne trade in and out of the U.S. sails through the waterway. Several Latin American countries use the canal to move roughly a quarter of their exports.

The drought has meant less water to feed the locks that allow ships to cross the canal. More than 50 million gallons of water are washed to sea every time a ship moves through the locks. That water is replenished from a reservoir that’s now running low.

The canal’s operator normally allows around 36 ship crossings a day. It cut the number to 24 in November and had planned to further cut the transits to 18 in February, but some rainfall helped to stabilize water levels.

To avoid potential multiweek delays in cargo movement, Dorian sent 10 ships to the Suez. Those voyages stopped in early December because of the Houthi attacks. Now ships are being routed again through the Panama Canal, amid longer waits and higher prices.

A single Panama Canal crossing costs around $500,000, with the exception of a handful of boxship operators that are the canal’s top clients. Companies like Dorian have to go through a bidding process where the highest offer secures a crossing. “We paid $2 million extra but we know others that paid close to $4 million more.” Hansen said. Dorian passed those higher costs to its customers.

Ship transits at the Panama Canal in January were down 36% from a year earlier.

The canal’s operator wants to invest around $1 billion on construction and engineering projects to increase access to water reserves, pending government approval. The project could take years to complete.

The canal also supplies water to about 2.5 million people, or around half the country’s population—and the drought is taking a toll on local businesses.

Sabina Torres runs a general store, Tienda 98, at a dock on Lake Alajuela, which is part of the freshwater network that feeds the Panama Canal.

Under the drought, the lake has receded from the dock. Water is available only every other day, from 7 to 9 a.m. Those days, the 46-year-old Torres scrambles to fill tanks and jugs with water for drinking, washing and flushing toilets.

Products that she sells typically arrive by boat, but fewer deliveries can now make it in. Torres bought an all-terrain vehicle and hired additional workers to navigate the mud and rocks and bring her products from the boats.

Torres’s store, which largely serves local residents, makes around $1,500 a month. That fell to $800 in both December and January. She’s now buying more items in advance to make sure she has enough stock. “We are rushing to get enough supplies,” she said.

Under attack

Around the world, prices are rising for cargo owners. Daily boxship rates along routes from Asia to the Americas more than doubled in January from a year earlier, data from U.K. brokerage Braemar showed. Rates for Asia-to-Europe trips were up 67%.

Trade volumes going through the Suez fell more than 40% in December and January compared with the year-earlier period, according to United Nations data. The canal is used by dozens of ships moving Asian exports to Northern Europe and the Mediterranean, along with some of the world’s biggest tankers moving oil from the Middle East.

Maersk, Hapag-Lloyd, and other large carriers of ocean freight haven’t returned to the Red Sea, despite the U.S.-led naval coalition’s attacks on the rebel group.

“To go back, we will need to meet a very high threshold to ensure our crews and ships are not in risk,” said Maersk Chief Executive Vincent Clerc, whose company typically made 15 to 17 Suez crossings a week. “So far there is an escalation and I don’t know if the attacks on the Houthis will help out things.”

Clerc said returning to the Suez would require guarantees from security officials that ships could travel safely through the region.

Nikolaev Balan, the executive officer of a European-owned tanker, has crossed the Red Sea and the Suez dozens of times. On Jan. 11, his ship was in the Red Sea during the first U.S. raid on Houthi targets in Yemen.

“We saw a drone flying a few meters from the stern and as we called it in to say that we are targeted. There were warnings on the radio to get out because the Americans will attack,” he said. “We turned back and we are not going back in there.”

In Egypt, supply boat operator Eman Ayad, 42, hasn’t earned much money to move cargo around the Suez over the past several weeks.

Ayad is one of about a dozen independent owners of boats regularly working in the canal zone offering towing services and supplies like food, lubricants and spare parts. The boat’s services generate about $800 a month.

He inherited the boat from his father around a decade ago and it serves as his family’s sole source of income. He said his family, including his wife and three small children, is living on savings.

“If this lasts for another month I will have to sell [the tugboat] to pay debts,” Ayad said. He’s thinking about immigrating to the U.S. where relatives could help him land a job if Suez business doesn’t return—and soon.

Not all vessels are ditching the Suez. Operators sailing the waterway to access the wider region via the Gulf of Aden and the Arabian Sea routinely hire armed guards to help repel attacks. Four guards per vessel can cost about $40,000 per Red Sea voyage, shipowners and operators said.

Toll revenue paid by ships to cross the Suez fell by almost half in January to $428 million, compared with $804 million in the same month last year, said Suez Canal Authority Chairman Osama Rabie. Along with tourism, the Suez Canal is one of the main foreign income sources for Egypt.

At the Panama Canal, the drop in permitted crossings hasn’t dented overall revenue, in part because the per-ship toll increased. The canal brought in $3.3 billion from tolls in 2023, up from more than $3 billion the year prior.

“The operators are complaining, but we try to accommodate as many crossings as possible. The weather has been very unforgiving,” said Ricaurte Vásquez Morales, the canal’s administrator.

Canal authorities don’t expect the bump from crossing fees to last. Ship operators prefer a steady toll regime and the canal wants good relations with its customers, Vásquez Morales said.

The canal authority plans to review the number of permitted daily crossings in April, depending on rainfall levels in March. It expects the effects of the drought to reduce its revenue this year by around $200 million, he said.