September 1st, 2012

Courtesy of Forbes India, an interesting look at some of the top small- and medium-sized businesses in Asia:

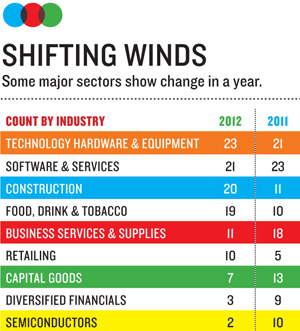

Against the backdrop of a fragile global economy, the makeup of our Best Under A Billion demonstrates why small and medium-size enterprises are considered essential to Asia-Pacific. Sales of this year’s 200 SMEs from 15 countries grew an average 48 percent last year and generated $47 billion in revenue while employing 370,000 people. But despite their size and rapid ascent, these are not flash-in-the-pan businesses. The average age is 24 years—publicly traded for 9 years. Among the 200 there are 46 making their sophomore appearance, another 17 returning after a gap year.

In total, 72 have appeared at least once on our list in the last decade.

To be considered, companies must first generate annual revenue between $5 million and $1 billion (US), have positive net income and have been publicly traded for at least a year. From that pool of candidates (900 this year) we weigh sales growth, earnings growth and return on equity in the past 12 months and over three years. We scrutinise the finalists to exclude companies that are thinly traded and those with accounting or major legal troubles.

The growth of listed entities in China has been fastest in the world in the years since the financial crisis. Our combined China-Hong Kong contingent numbers 72, up from 65 last year; 20 of them return from last year. Changyu Pioneer Wine, a perennial favorite, has expanded at a steady 21 percent clip the last three years and may grow off.

Online travel service Ctrip holds the record for the longest consecutive streak on our list, at six years. Yet growth across all metrics lagged in Ctrip’s industry, business services and suppliers, and a dwindling number qualified. That sector’s weakness was a big reason India’s total on the

list fell to 23 from 35 last year.

Image: Robin Skjoldborg / Getty Images

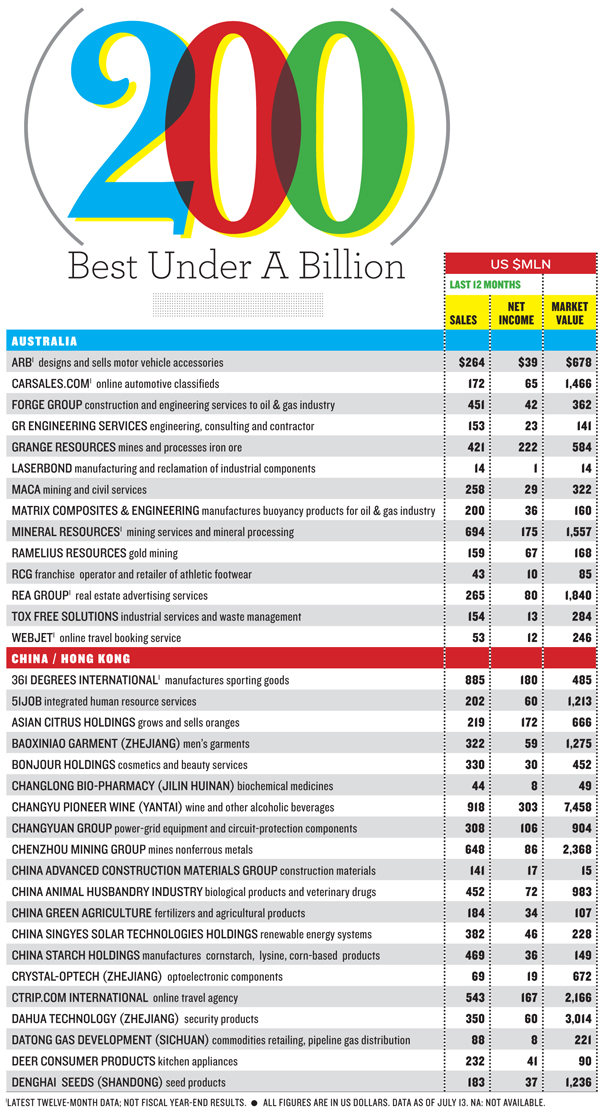

RCG

AUSTRALIA

Australia’s largest retailer of athletic footwear operates 148 stores in the homeland and New Zealand. The company also owns the Shoe Superstore chain of comfort footwear and, having acquired the country’s rights to distribute the Merrell brand of lifestyle shoes, opened its first branded flagship store in 2010.Deer Consumer Products

CHINA / HONG KONG

Its most popular products are blenders and juicers, sold domestically under the Deer brand name.Image: Imaginechina

Perfect World

CHINA / HONG KONG

The Beijing online game developer is a leader in 3-D massively multiplayer online role playing games (MMORPG), an industry estimated to generate $6.1 billion in revenue this year. Its portfolio includes adventure games Perfect World, Perfect World II and Legend of Martial Arts.Eros International Media

INDIA

Capitalising on the superhero action film genre, film and entertainment company Eros scored big last year with its Ra.One. It was an instant blockbuster setting an opening day record, and it remains one of the highest-grossing films in the country.

Lovable Lingerie

INDIA

The Mumbai intimate apparel manufacturer has found that while the majority of Indian women prefer white cotton brassieres, they are a fragmented market. The company’s three brands—its namesake Lovable, Daisy Dee and College Style—take care of covering the high-end to the contemporary and every consumer in between. Items are available in about 10,000 retail stores.Mamiya-Op

JAPAN

While its electronic equipment division has been selling pachinko machines (a Japanese-style pinball game) regionally, the sports division has been pitching its golf shafts and golf-related products globally. Its customers range from consumers to original equipment manufacturers like Callaway, Nike and Titleist, and its products can be found in 30-plus countries.

Murree Brewery

PAKISTAN

This brewery was originally established in 1860 to satisfy the unquenched thirst of the occupying British military. While the Brits have been long gone, beer remains the company’s most popular beverage, generating 70% of its sales—this despite the fact that 97% of the country is Muslim and forbidden alcohol, and Pakistani law prevents the company from advertising it. The company’s expanded beverage portfolio includes hard liquor and nonalcoholic soda and fruit juices.Image: Runstudio / Getty Images

Able C&C

SOUTH KOREA

This cosmetics company has managed growth without much glitz or glam. It has bucked the trend in its industry and skimped on fancy product packaging and supermodel cover girls and undercut the major players in pricing. The company’s marquee brand, Missha, is sold in branded stores and online at company-owned Beautynet.

Image: Reuters

S.M. Entertainment

SOUTH KOREA

This independent record label is one of Korea’s “big 3” in the industry, heavily vested in the Korean pop genre of music. Its top band, Girls’ Generation, a 9-member all-girl group recently voted Korea’s most popular musicians, generated revenue of $85 million, or 34% of its 3-year sales.Gourmet Master

TAIWAN

Known as the Starbucks of Taiwan, this company’s 85 degrees Cafes are conducive to eating and lounging—food items accounted for 71% of sales last year. This year the company is expanding to Hong Kong, opening 5 outlets to add to the 330 it has in Taiwan, 270 in China, 5 in Australia and 2 in the U.S.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.