March 31st, 2024

Courtesy of the Financial Times, a report on Indonesia’s plan to accelerate nickel output despite low global prices:

Indonesia will press on with plans to expand nickel output despite a supply glut that is forcing rivals to shut down mines, as the world’s top producer aims to keep prices low and protect long-term demand for the metal crucial to electric car batteries, a senior government official has said.

The country’s production capacity for battery-grade nickel is expected to quadruple to 1mn tonnes by 2030, said Septian Hario Seto, the deputy co-ordinating minister for investment and mining. Capacity for nickel pig iron, which is used to make stainless steel, is projected to expand by up to 15 per cent in three years from the current 1.9mn tonnes, he added.

Nickel prices have slumped 30 per cent in the past year on elevated supply from Indonesia and softer demand. More than half of global nickel production is unprofitable at current prices of about $16,500 per tonne.

“We don’t see any reason why we should not expand production of nickel for battery materials,” Seto told the Financial Times. “What we want to achieve is price equilibrium. The responsibility for us as the biggest nickel producer is to supply enough nickel so that the EV [electric vehicle] transition can progress smoothly.”

The surge in low-cost nickel supply from Indonesia will wipe out rivals in the next few years, the head of French miner Eramet warned last month. Australia’s Wyloo Metals is shutting down nickel mines in Western Australia, while BHP has said it is considering the closure of some nickel operations.

But Seto said increased output amid output cuts elsewhere would help stabilise nickel prices that have been volatile in recent years. He projected long-term nickel prices — which briefly traded above $100,000 a tonne in 2022 — would be between $18,000 and $19,000.

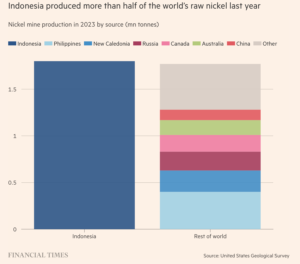

Indonesia has previously proposed a nickel version of the Opec group of oil-producing nations. But analysts said south-east Asia’s biggest economy was well-positioned to shape global supply and prices on its own. With the world’s largest reserves of the mineral, it commands a market share of more than 50 per cent.

Seto also raised the prospect of consistently higher prices pushing carmakers away from nickel-based batteries towards cheaper, nickel-free options such as lithium iron phosphate batteries. “In the short term, you enjoy a very good profitability with higher prices. But if this level is maintained, you sacrifice long-term demand,” he said. “And for a country like us, where we care about our downstream programme, that is really important.”

He referred to Indonesia’s effort in recent years to build a domestic EV ecosystem on the back of its vast nickel reserves. Outgoing President Joko Widodo banned nickel ore exports in 2020, forcing smelters and battery makers to set up plants in the country.

His successor Prabowo Subianto, who will take over in October following a landslide election victory, has vowed to maintain that trajectory. Carmakers such as China’s BYD have announced plans to establish manufacturing operations in the country.

Any significant threat to nickel demand would damage Indonesia’s economy. Foreign direct investment has hit records in recent years, and the current account balance reached a surplus in 2021 after a decade of deficits thanks to the boost to the domestic nickel industry.

“From Indonesia’s perspective, they want to protect the industry as it is a substantial revenue source and contributor to the economy,” said Harry Fisher, a senior consultant at Benchmark Mineral Intelligence. “They have got reason to try to keep prices at a sustainable level. And they have got some leverage.”

Benchmark Mineral Intelligence estimates Indonesia’s annual nickel output will grow to 3.02mn tonnes by 2030 and account for 65 per cent of global supply, up from 1.71mn tonnes and 51 per cent in 2023.

Indonesia also maintains an optimistic outlook on demand for EVs, despite a recent slowdown flagged by Tesla and other carmakers. Seto said the government was confident in appetite for nickel batteries, which have higher recycling potential and better performance than lithium iron phosphate batteries.

Sabrin Chowdhury, head of commodities at BMI, a unit of Fitch Solutions, noted that lower nickel prices might not guarantee sustained demand as lithium batteries were cheaper.

Indonesia’s expansion would be “more catastrophic for nickel producers in the longer term”, she added. Event details and information

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.