Courtesy of The Guardian, an interesting article on Kabul’s property boom:

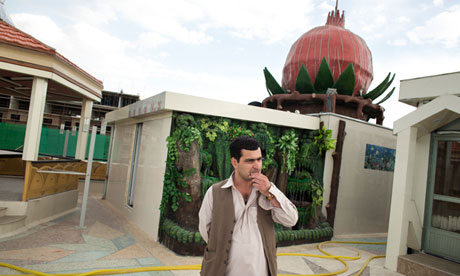

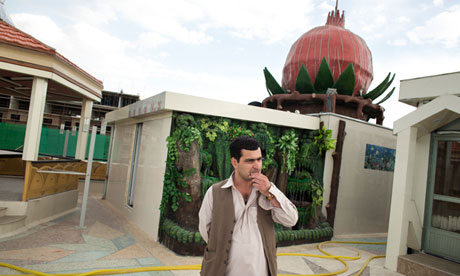

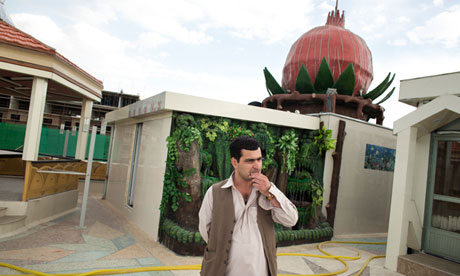

Faizullah Barakzai under the giant roof-top pomegranate that crowns the luxury apartment block he has built in Kabul. Photograph: Joel Van Houdt for the Guardian

Faizullah Barakzai under the giant roof-top pomegranate that crowns the luxury apartment block he has built in Kabul. Photograph: Joel Van Houdt for the GuardianTwo giant concrete pomegranates loom over downtown Kabul, with bright red, 15ft-tall seeds bursting from their sides and lit at night with dancing pink lights.

The sculptures adorn the top of the orange, silver and blue “Pomegranate Towers” apartment block, one of the more garishly ostentatious buildings thrown up by Kabul’s nouveau riche but also an unlikely token of hope in city threatened by a tenacious insurgency as foreign troops leave.

“I get a lot more confidence from looking at these awful buildings. It kills me as an architect, but from an economic point of view it seems to be quite a vote of confidence,” said Jolyon Leslie, a South African with several decades experience of restoration and urban planning in Afghanistan. “Everyone is talking about the tide going out economically, but everyone is still investing in these fancy buildings … they are making a long-term bet the city will stay stable enough to earn it back.”

Builder Faizullah Barakzai’s tower, which pays tribute to his hometown of Kandahar, famous for its autumn crop of sweet, juicy pomegranates, is part of a building boom that has transformed the Afghan capital in little more than a decade.

Faizullah Barakzai (right) confers with a worker inside the top-floor apartment of the Pomegranate Tower. Photograph: Joel van Houdt for The Guardian

“There is a lot of negative propaganda, but I think that eventually the rich Afghans who take money out of the country will regret it,” Barakzai said after a tour of his glitzy penthouse suite.

Once a sleepy mountain town of low-rise homes, Kabul’s smartest areas are now a grid of multicoloured, multi-storey family palaces studded with mirrors and stucco, one even boasting a rooftop lion enclosure.

The rich gather to celebrate their children’s unions at opulent wedding halls, one guarded by golden elephants, another by a looming model of the Eiffel tower. There are bowling alleys, supermarkets crammed with imported clothes and food, and leisure centres with pools and saunas.

The lavish lifestyle has been funded by an influx of foreign money and the proceeds from drugs, which have enriched a tiny elite while most of the country still grapples with desperate poverty, malnutrition, illiteracy and some of the lowest life expectancy in the world.

Emzee, a fashion shop at the Majid mall in the Shar-e Naw (new city) area of Kabul. Photograph: Joel van Houdt for The Guardian

Nato combat troops will be gone by the end of 2014 and as they head home, spending is shrinking. There is widespread fear that Afghanistan faces economic collapse, a security vacuum and a repeat of the civil war that ripped the country apart in the 1990s.

Rents and land prices in the capital have fallen as people hedge their bets and opt for more portable investments. That choice is made easier in a country where tracking of wealth is in its infancy, as evidenced by a former vice-president who once flew to a Gulf state with $52m (£34m) in cash, according to a US diplomatic cable published by WikiLeaks.

Trust in the financial system was further undermined with the near-collapse of the top private lender Kabul Bank in 2010, amid a $900m corruption scandal, exposing a web of dubious assets including a clutch of villas in Dubai.

Rather than experiencing a slowdown in its frenetic building sector, however, Kabul is increasingly overrun with precarious apartment blocks. Cement and brick walls climb ever higher in defiance of planning laws, frequent earthquakes and the threat of war. If cranes are a benchmark of economic growth, then this city is booming.

Early evening at the entrance to one of the most expensive wedding halls in Kabul, the City Star Hall. Photograph: Joel van Houdt for The Guardian

“The phrase ‘2014’ is a form of psychological warfare,” said builder Hasan Ali Sakhizada, who has invested around $1m in a block of apartments for rent and sale, and a luxurious home. “It’s not going to have an effect on the property market, because people still need somewhere to live.

“Everyone says the Americans are leaving but they are not. They have invested too much in Afghanistan. The current problems are just politics by the US to help them negotiate their strategic pact [for a long-term military presence].”

The new buildings are a dramatic contrast to the muted colours and elaborate handicrafts that adorned the homes of Afghanistan’s traditional elite, hidden behind high, plain walls.

The new rich want their wealth on show. “After we finished work on the pomegranates, someone driving past had a road accident because he was staring at them,” Barakzai said with obvious pride.

He has personally furnished the penthouse apartment, reached by a gold-lined lift, with plush leather furniture, ceilings swept with gilt and carving, shining parquet floors, cabinets of curios and statues backlit in neon pink, green and blue, and a television that responds to voice commands.

Afghans in Sauna Nazary, a swimming pool which opened to the public a month ago. Photograph: Joel van Houdt for The Guardian

“I wanted to make it as luxurious as possible,” said Barakzai in a tiny office at the base of the tower, where staff drank sweet, milky coffee he swore was the best in Kabul, and cans of Red Bull.

“One of my dreams is that the homes which are mud will all be concrete and beautiful, like buildings in our neighbours India and Pakistan. In other countries there are a lot of tall buildings, so I wanted to do something similar for Afghanistan.”

The country’s new rich may like to show off their wealth, but they are less keen about discussing where it came from. Barakzai said his apartment plot was built on family land that once held a bungalow and garden, building on a long family history of entrepreneurship.

Funding came from advanced sales of apartments, he said, even though he put the average unit price at a modest $90,000, and admitted that his commercial empire now includes another construction site near Kabul’s parliament and a wedding hall, hospital and supermarket in southern Kandahar.

A wedding band arriving to perform at a ceremony at the City Star Hall. Photograph: Joel van Houdt for The Guardian

The Barakzai family clearly have powerful connections. Among the vehicles in the basement car park are those of a deputy provincial governor and a senior intelligence official, both among the new tenants of the 32 apartments.

Their luxury armoured SUVs are a subtle boast of Barakzai’s impressive neighbours, but may also hold a clue to one prop for the Kabul property boom as western cash dries up and an escalation of violence looms.

“It used to be you had a guest house where people could stay, and your wealth would be judged by the number of guests who could sit down to dinner,” said Leslie. “This is a latter-day way of dispensing patronage, because I’m sure the tenants aren’t paying full market rate.”