August 24th, 2022

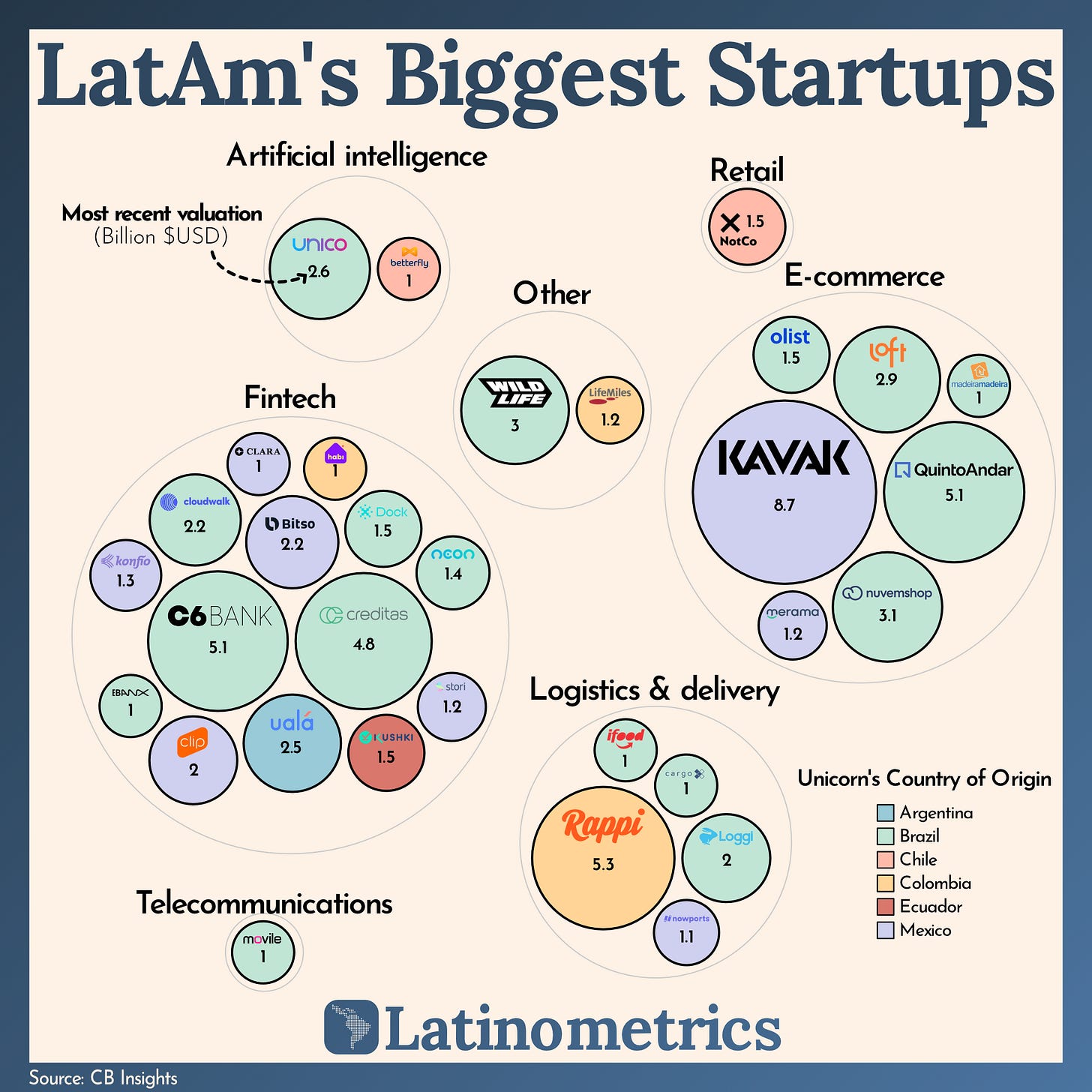

Courtesy of Latinometrics, an updated look at Latin America’s biggest start ups:

LatAm’s Biggest Startups

One of our first charts was about Latin America’s unicorns (startups worth $1B+). In November of last year, we reported 21 of them. Today, about ten months later, there are 32. By far the most significant increase happened in Mexico, where unicorns doubled to a total of eight.

Even though the region’s most notable Fintech, Nubank, is no longer a unicorn because it’s now a publicly-traded company, the Fintech sector’s unicorns also doubled since that time — from 7 to 14.

With a total of $5.5B invested in the first half of this year, Latin American startup funding has slowed down compared to 2021. But let’s put things into perspective: according to Crunchbase numbers, in just the first half of 2022, there was more funding in Latin America than in all of 2019 (pre-pandemic) and almost 3x the total amount of 2018.

When there are economic downturns, it’s essential to step back and consider the broader trend that’s taking place. In this case, Latin America remains one of the hottest markets for startups, and investors will continue to bet on promising founders solving big problems.

Enter Aron Schwarzkopf, CEO and Co-Founder of Kushki. Kushki made history for Ecuador when it became a unicorn in June, raising a total of $194M since its inception in 2017. That amount is unprecedented in the country; we could find no records of an Ecuadorian startup receiving more than $5M in total funding ever. Kushki enables global businesses to accept digital payments in countries where the technology is not quite there yet (similar to Uruguay’s dLocal).

Founders like Aron are breaking barriers and setting the example to embrace technology and create the next generation of wealth for LatAm. Which country will be next to see its very first unicorn?

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.