March 31st, 2024

Courtesy of The Financial Times, an article on Macau’s recovery which has it set to become one of world’s fastest-growing economies:

Clutching a Dior handbag and wearing a jacket from French designer Ami, Jacky Chen, who works in real estate in Shenzhen, came to Macau to eat, relax and gamble.

“People will spend where they need to spend,” he said from outside the newly opened Londoner resort — a labyrinthine edifice in the style of the Palace of Westminster containing several hotels and a 351,000 sq ft of gambling space. He added that he had just made a small winning on a bet of about HK$5,000 (US$640).

Millions of tourists like Chen are returning to Macau, driving a recovery for its casinos after years of strict Covid-19 controls and a Beijing-led crackdown induced a slump that had some in the city fretting over its future as the world’s largest gambling hub. Chen exemplifies not just the city’s recovery but also a shift in Macau’s clientele from high rollers to mass-market gamblers.

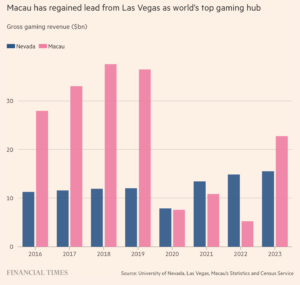

The IMF forecasts that Macau’s economy will grow 13.9 per cent in real terms this year, following growth of 80.5 per cent last year, making it one of the world’s fastest-growing economies. The government expects its gross gaming revenue to grow to 216bn patacas ($27bn) in 2024, up from 183.1bn patacas last year and likely well ahead of the entire state of Nevada. Macau is the only Chinese territory where casino gambling is legal.

“Macau is doing amazingly well,” said Bill Hornbuckle, co-chair of MGM China, which last month reported its highest quarterly adjusted earnings before interest, tax, depreciation and amortisation, on an earnings call. “We’re in the game for real for the long haul.”

An influx of mass-market gamblers has offset a slower recovery for the VIP segment after Beijing authorities in 2021 launched a multiyear crackdown on junkets, promoters that operators once relied on to attract — and extend credit to — high-spending mainland gamblers.

Investors had feared the crackdown, which culminated in the arrests of the heads of the city’s two largest junkets, and the imposition of new rules regulating the industry, would deprive casinos of crucial income from big spenders and spell an end to nearly two decades of rising casino profits in the former Portuguese colony.

Those fears followed the imposition of a new law in 2022 that granted authorities greater oversight of the sector. Beijing has also been pushing the territory to diversify its income beyond gambling. Macau’s six concessionaires pledged that year to invest $15bn over the next 10 years, with more than 90 per cent to be spent on non-gaming projects.

Analysts said reining in the junkets — which now number just 18 compared with nearly 100 in early 2020 and are limited to working with just one operator at a time — would probably keep the city’s gambling revenues below pre-pandemic levels in the coming years.

But the new focus on the mass market may help to improve casino margins, with operators no longer paying expensive commissions to junkets on VIP tables.

“The margin [for] a casino on a junket is 10 per cent,” said Alidad Tash, managing director of consultancy 2NT8. “That means $10 out of every $100 goes to the casino’s pocket. On the mass [market], it’s [35 to] 40 per cent. So if I lose $4 million in the junkets, I only need to make $1 million in mass to recover it. Because it’s four times more profitable.”

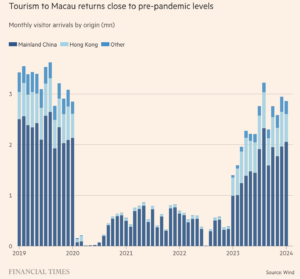

Gross gaming revenue in the city rose 67 per cent year on year to 19.3bn patacas in January, putting it at 77.5 per cent of the level during the same month in 2019, before the Covid-19 pandemic, according to figures from the Gaming Inspection and Coordination Bureau.

Casino operators including Wynn Macau, MGM China and Sands China have reported triple-digit growth in their preferred earnings metrics in quarterly results released in recent weeks, buoyed by mass-market sales that have exceeded pre-Covid levels and strong growth in retail spending.

Analysts at JPMorgan noted that MGM China’s adjusted ebitda figure of HK$2.2bn was its highest ever, while revenue at mass tables was 174 per cent higher than during a comparable period before the pandemic.

A large-scale return of mainland Chinese tourists to the city, which welcomed a total of 1.36mn visitors during the weeklong lunar new year holiday in February, has fuelled growth, despite an economic slowdown and sluggish demand in China.

“China’s economic slowdown may have some impact on [mainland] residents’ visitation to Macau, but perversely that impact may not be entirely negative,” said David Green, chief executive of Macau-based Newpage Consulting. “Adverse economic circumstances can encourage greater risk-taking.”

But with the exception of MGM China, which gained sharply following its results last month, the Hong Kong-listed shares of the five other big Macau casino operators have fallen over the past year. Analysts said investors remained wary of the substantial debtloads the casino groups took on to fund operations during the Covid-19 pandemic.

Mainland tourists returning to Macau said that in addition to being a gambling centre, it was an attractive destination for short shopping breaks.

“I don’t think [the economic situation] will have too big an impact if I’m just here for a few days,” said a visitor in his 40s from the mainland who gambled several tens of thousands of renminbi during a one-night trip to the city. “You might say the economy isn’t doing well?.?.?. [but] the people who come to play here definitely have money.”

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.