December 8th, 2020

Via South Asia Investor Review, a look at Pakistan’s infrastructure investment:

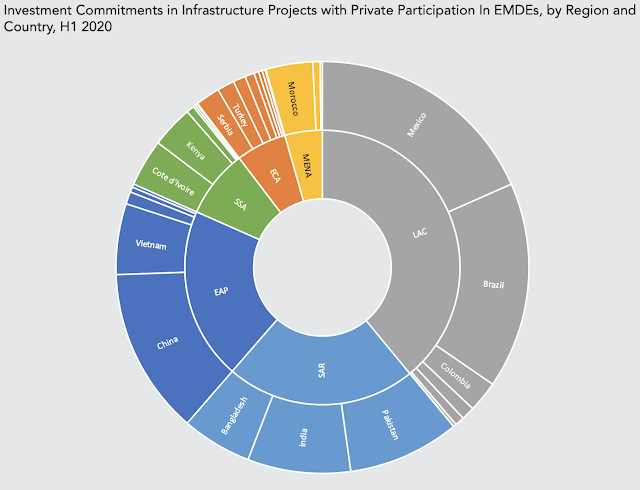

Pakistan led South Asia region and ranked 4th in the world in infrastructure investment commitments in the first half of 2020, according to World Bank’s “Private Participation in Infrastructure” report for the first half on the year 2020. Mexico led the pack with $4,016 million, followed by Brazil 2nd with $3,543 million, China 3rd with $2,859 million, Pakistan 4th with $1,921 million and India 5th with $1,762 million in private infrastructure investment commitments in the first 6 months of 2020. Here is an excerpt of the World Bank report:

“Pakistan had the fourth highest investment commitments—a new entrant to the top five countries this year—with US$1.9 billion of investment commitments, accounting for 0.69 percent of GDP. This can be attributed to the financial closure of the Thar Block-I Coal-Fired Power Plant, which was the only project to reach financial closure in the country during this time period. The Thar power plant and the pipeline in Mexico were the only two megaprojects to reach financial closure in the first half-year of 2020. Lastly, India had the fifth highest investment commitments, at US$1.1 billion, accounting for 0.06 percent of GDP. In the first half-year of 2020, these five countries together attracted US$14.1 billion, representing 64 percent of PPI investments in EMDEs”.

Global Infrastructure Investment by Private Participants. Source World Bank

The report went on to say that Pakistan’s entrance to the top 5 list can be attributed to the financial closure of the Thar Block-I Coal-Fired Power Plant, which was the only project to reach financial closure in the country during this time period. The Thar power plant and the pipeline in Mexico were the only two megaprojects to reach financial closure in the first half-year of 2020. Here’s another excerpt of the World Bank report:

“Pakistan became one of the five countries with the most investment in the first half-year of 2020, due to a US$1.9 billion mega coal power project with 1,329-megawatt (MW) capacity. The coal power project was developed under the umbrella of the China-Pakistan Economic Corridor (CPEC). It is part of an effort by the Government of Pakistan to improve energy security and reduce the average cost of power generation by transitioning from oil to coal”.

In a 2018 New York Times Op Ed titled “How Not to Engage With Pakistan“, ex US Ambassador to Pakistan Richard G. Olson said “Its (CPEC’s) magnitude and its transformation of parts of Pakistan dwarf anything the United States has ever undertaken”. Olson went on to warn the Trump Administration that “Without Pakistani cooperation, our (US) army in Afghanistan risks becoming a beached whale”.

Among the parts of Pakistan being transformed by China Pakistan Economic Corridor (CPEC) are some of the least developed regions in Balochistan and Sindh, specifically Gwadar and Thar Desert.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.