September 28th, 2022

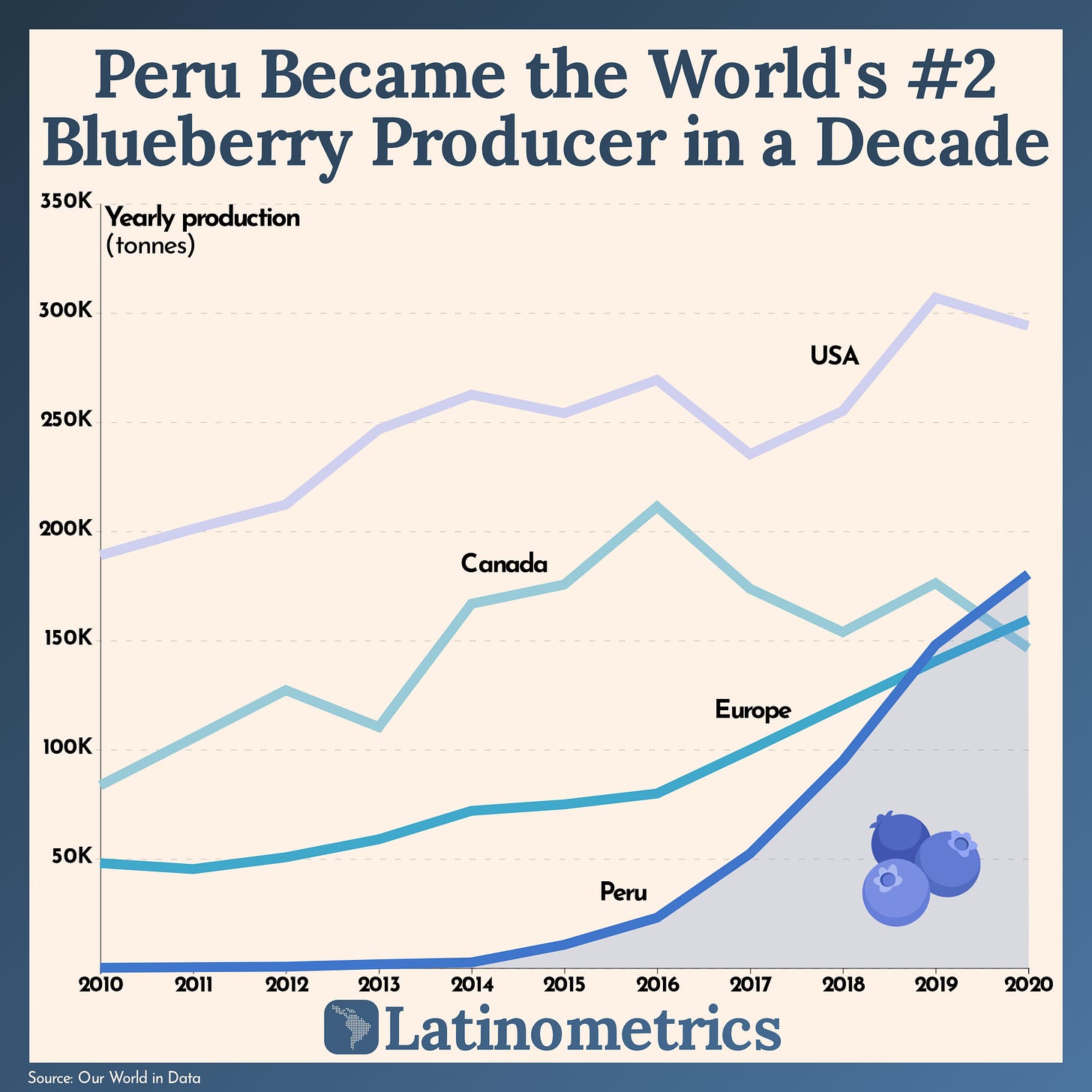

Via Latinometrics, a report on how Peru became the world’s #2 blueberry producer in a decade:

Carlos Gereda was the spark that lit Peru’s blueberry boom of the past decade. He asked a simple question: “can blueberries grow in Peru?” In 2006, he brought 14 varieties from Chile to see which ones adapted well to the Peruvian climate. He narrowed it down to four and, in 2009, founded Inka’s Berries. The company’s service consisted of assisting the development of plantations that adhered to the growing standards Carlos had conceived. The blueberry revolution ensued.

In a very short time, Peru became the world’s number two producer of blueberries and the world’s number one in exports and per capita production. Seriously, the growth resembles that of bitcoin’s value. In 2010, Peru produced 30 tons of blueberries; in 2020, 180K. That means that production multiplied by more than 6,000x in ten years. Blueberries are now the country’s 2nd most significant export, just behind grapes.

This new industry ($1B in 2020) that was born seemingly out of nowhere is being led by corporations that can afford the high cost of entry. Most notably, Camposol and Hortifrut hold a combined 34% of the market.

Peru’s climate allows for year-round production, giving the country a competitive edge over seasonal agriculture. The productivity of Peruvian land is 13 tons per hectare. The world’s top player, the USA, produces 8 tons per hectare. Given the massive competitive edge, we believe it’s only a matter of time before Peru becomes the blueberry capital of the world.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.