June 2nd, 2023

Via Bloomberg, a report on the DRC’s continued growth in copper production:

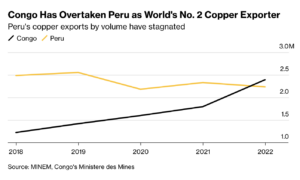

The Democratic Republic of Congo displaced Peru as the second-biggest copper exporter last year, official data from the two countries show, in a changing of the guard for the mining industry.

While the numbers used in the chart below refer to shipments rather than production, the shift in positions underscores a couple of important trends. Firstly, an up-tick in social unrest and political uncertainties are constraining investment in South America, as more money flows into Africa’s rich ore-bodies.

Peru had sat comfortably as the biggest copper producer and exporter after neighboring Chile for years thanks to a wave of projects earlier this century that has largely dried up. In recent years, political upheaval and community protests have helped keep the country’s copper exports fairly flat.

Congo, meanwhile, has been making huge strides thanks largely to the high-grade ore now being tapped by Ivanhoe Mines Ltd. in Kamoa-Kakula. Congolese exports have more than doubled since 2018 to 2.4 million tons. Peru shipped 2.2 million tons.

While copper mines in Congo have also faced disruptions, such as a prolonged export halt at Tenke Fungurume, they haven’t halted its growth.

Read More: Peru Seen Losing Title of No. 2 Copper Producer Soon to Congo

It’s unclear if this is a temporary blip or a more long-lasting reordering. Much will depend on whether Peru can garner political consesus to bring on new projects and prevent disruptions.

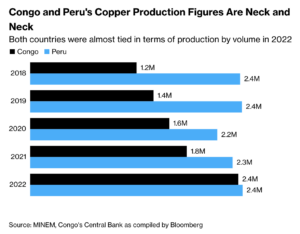

In terms of production, the two nations are neck and neck, according to Peru’s mining ministry and Congo’s central bank. Consulting firm Wood Mackenzie said this week that Congo would only fully take over Peru in terms of production by 2026 or 2027.

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.