July 4th, 2023

Via Amwaj Media, a look at the rising Sino-Qatari gas collaboration:

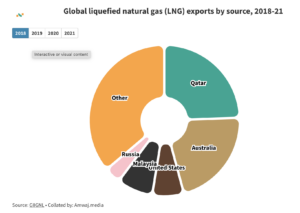

As the importance of China’s role in the global liquefied natural gas (LNG) sector grows, the energy dimensions to Sino-Qatari relations have significantly deepened. The shift is taking place in a context featuring rising tensions in China’s relationships with two top competitors of Qatar in the LNG export market—Australia and the US. Against this backdrop, Beijing views Doha as an increasingly stable energy partner and resource investment target.

Record deals

On June 20, state-owned QatarEnergy and China National Petroleum Corporation (CNPC) signed a 27-year deal with the former agreeing to annually provide the latter with 4M tons of LNG. The move follows an identical 27-year agreement between QatarEnergy and China Petroleum & Chemical Corporation (Sinopec) penned last November. At the time, the deal was the longest LNG supply contract ever signed.

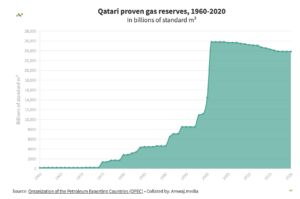

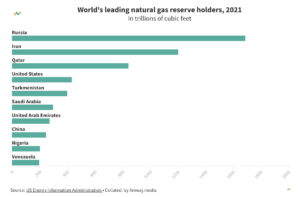

China is doing well in the race to secure supplies from the expansion project of the North Field, Qatar’s share of the world’s largest gas field. Neighboring Iran’s section of the reserve is known as South Pars. CNPC also took an equity stake in the eastern expansion of the North Field LNG project as part of another agreement signed on June 20. The stake amounts to 5% of an LNG train with an annual capacity of 8M tons. Of further note, Sinopec on Apr. 12 became the first Asian energy giant to establish itself as one of the “value-added” partners in Qatar’s North Field project.

When QatarEnergy and CNPC signed their deal last week, Qatari Energy Minister—and QatarEnergy CEO—Saad al-Kaabi, declared, “Today we are signing two agreements that will further enhance our strong relations with one of the most important gas markets in the world and a key market for Qatari energy products.”

While novel and unique in their length, these agreements are not surprising. Nor do they say anything new about Beijing-Doha relations. Instead, they are the “encapsulation of the general trend and direction of the relationship, which is to have longer and more significant energy relations between [China and Qatar],” explained Dr. David Roberts, an Associate Professor at King’s College London. In an interview with Amwaj.media, he elaborated, “China is a country that needs huge amounts of energy imports which means they are keen to build relations up and down and across the Middle East. Qatar is a key part of that.”

The 27-year QatarEnergy-CNPC LNG supply deal highlights Beijing’s “long-term attention to the Persian Gulf and its willingness to cultivate commercial, and therefore political, ties with regional actors over time,” Dr. Mehran Kamrava, a Professor of Government at Georgetown University Qatar, told Amwaj.media. “China is a dependable commercial market, and also a potentially useful counterweight to US economic, and political, dominance in the region.”

Amid great instability in parts of West Asia, deals such as the one between QatarEnergy and CNPC “signal China’s intent to expand its presence primarily through trade, rather than military force,” explained Dr. Steven Wright, an Associate Professor of International Relations at Hamad Bin Khalifa University. “For both Qatar and China, this new partnership promises to yield both economic gains and geopolitical dividends for years to come.”

In terms of the energy trade, there is an interdependency between Beijing and Doha. Last year, Qatar replaced Australia as China’s top LNG provider. At present, the Chinese rely on Qatar for more than half of their LNG imports. The QatarEnergy-CNPC deal is significant for Doha. For the Qataris, “China is growing in its significance as a reliable customer,” explained Dr. Andreas Krieg, an Associate Professor at the Defence Studies Department of King’s College London. “For all the Gulf states, including Qatar, China is a reliable long-term market.”

Although the Qataris have greatly boosted their investments in LNG exports, Doha has faced difficulty in finding long-term customers in the sector which Qatar is accustomed to, explained Dr. Kamrava. “Insurance rates for goods passing through the Persian Gulf are especially high, and some of Qatar’s usual LNG customers, such as South Korea, are reluctant to sign long-term deals. So, this [QatarEnergy-CNPC deal] is particularly important for Qatar.”

A foreign policy of “hedging”

In the 2000s and early 2010s, Doha balanced relationships with the US, Iran, Syria, Saudi Arabia, Israel, Lebanon’s Hezbollah, and the Palestinian Hamas movement off each other to enhance Qatar’s geopolitical leverage in the region.

Today, the gas-wealthy emirate is doing the same between global powers. “Qatar has often walked a fine line between actors that have been hostile to one another and has adopted a strategy of hedging in its international relations,” Dr. Kamrava told Amwaj.media.

Qatar’s continued investment in its close partnerships with western countries while also deepening its energy relationship with China is characteristic of the “hedging” in Doha’s foreign policy strategy. Despite the mounting friction in Beijing-Washington relations, Qatar’s alliance with the US has not stopped Doha from growing its energy ties with China. Similarly, Doha and Moscow have also maintained a positive relationship following Russia’s invasion of Ukraine last year.

Taiwan-related risks and Qatari resilience

A China-US military confrontation over Taiwan—Qatar’s sixth largest LNG export destination—would leave Qatari policymakers facing dilemmas. Under such extreme circumstances, Qatar would strive to protect its positive relations with both China and the US. “If such a nightmare scenario came to fruition,” Dr. Kamrava explained, “Qatar would do its best to maintain the status quo in its relations with both parties.”

Indeed, the extent to which Qatar’s LNG exports are diversified would bode well for Doha in the event of such an armed conflict, or other circumstances in which Qatar might come under pressure to move away from its energy relationship with China. To put things into perspective, South Korea, Japan, and India collectively accounted for 54.6% of Qatar’s LNG exports in 2021. The top destination, South Korea, represented only 15.6% of the Gulf Arab state’s gas sales.

This diversification can afford Doha some maneuverability. “The way that the Qataris set up their LNG industry and orchestrated its customer base, you realize that the Qataris are kind of resilient—far more resilient on changes in export markets…than the Chinese,” Dr. Krieg told Amwaj.media. “If for whatever reason there were sanctions in place against China, I do think the Qataris would fare pretty well considering how diversified their customer base is.”

Ultimately, the long-term contracts that Qatar has signed with Chinese state-controlled energy companies provide Doha with the assurance of demand stability. This is exactly what Qatar wants in a world fueled by geopolitical instability. Dr. Wright explained that for policymakers in Doha, it is critical to ensure that LNG—Qatar’s main export and source of wealth—does not become a political bargaining chip between the west and China. “Qatar has spent decades cultivating its role as a reliable and neutral energy supplier, and it is simply unrealistic to assume it would abandon its policy due to political pressure.”

If Taiwan-related tensions between China and the US spiral out of control, Doha could probably “offer to mediate tensions and use its experience as a go-between for adversaries to prevent further escalation,” Dr. Wright told Amwaj.media. “As the world’s top LNG exporter with customers around the globe, Qatar is an apolitical actor focused on fair commercial dealings. While China is its leading trade partner, Qatar’s leadership also values its long alliance with America. Suspending or limiting LNG shipments risks severely damaging its reputation and relationships.”

Amid any nightmarish military confrontation over Taiwan, Doha would likely use its diplomatic cards to push for dialogue while seeking to use its unique leverage in ways that could offer Beijing and Washington an off-ramp. Ultimately, the wealthy Gulf Arab state “views itself as having more to gain through mediation than taking sides,” said Dr. Wright, “Preserving stability is Qatar’s top priority.”

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.