The Middle East is widely recognized for its significant role in the global energy market. However, countries in the region also foster other substantial industries, including metals, chemicals, and agriculture.

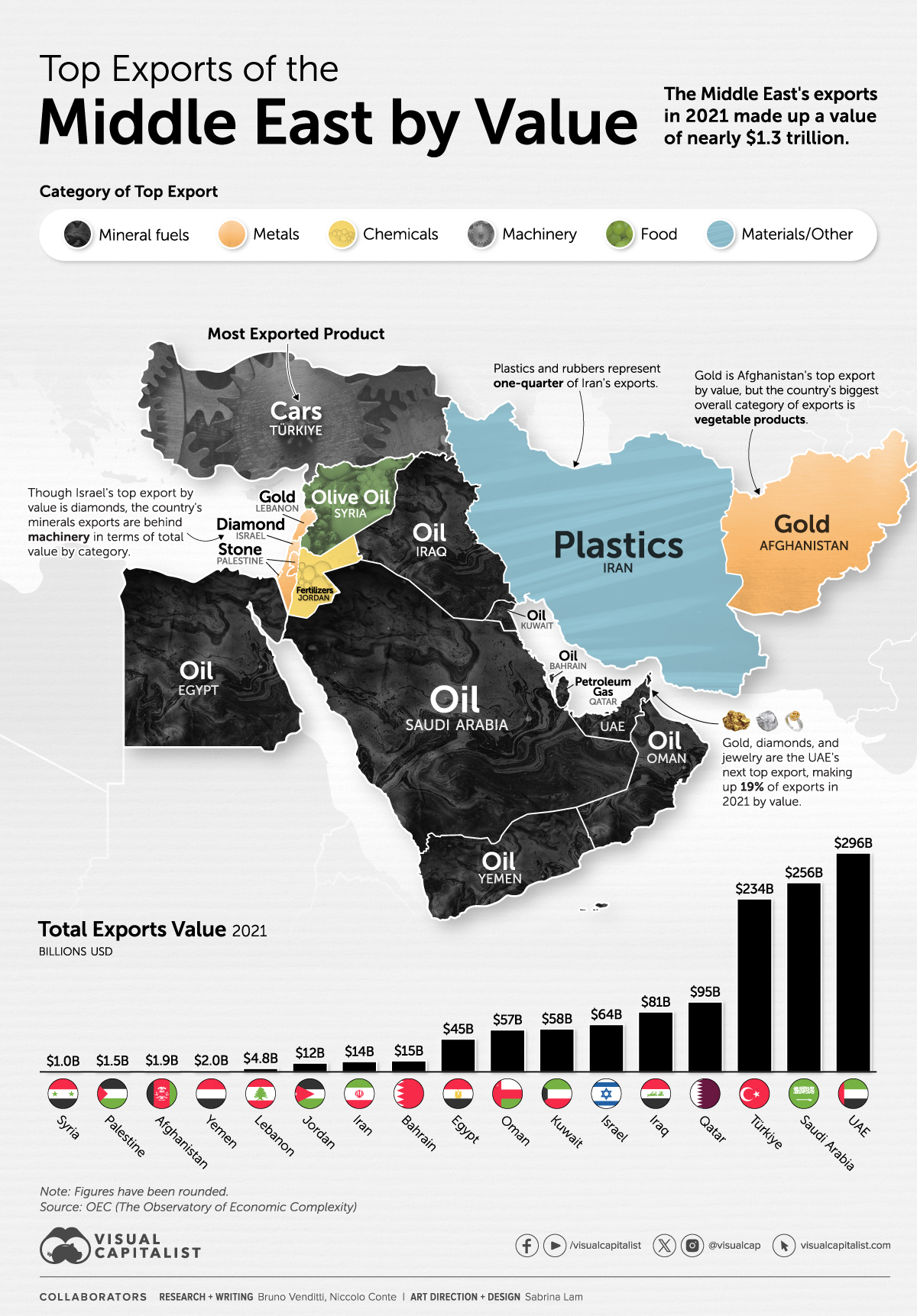

The graphic above uses 2021 exports data from The Observatory of Economic Complexity to help explain the economy of the Middle East.

?? Though Afghanistan is not part of the traditionally defined Middle East, we’ve included it due to multiple organizations counting it as part of the region.Top Exports by Middle-Eastern Countries in 2021

In 2021, the Middle East’s exports reached a total value of $1.27 trillion. While the region lags behind Asia, Europe, and North America in global exports, it outpaces Africa and South America.

Despite many countries undertaking efforts to diversify their economies and reduce their oil dependence, most of the exports still come from fossil fuels.

The Middle East accounts for one-third of global oil production, producing over 30 million barrels per day. Five of the world’s top 10 oil producers are located in the region.

But some countries like Türkiye show off more diverse economies. The country’s exports range from minerals to machinery and textiles, with cars as its top export. The country is actually one of the world’s top automotive exporters.

Israel is another of the Middle East’s most diverse economies. The country’s major exports encompass electronics, software, and refined petroleum, but cut diamonds rank as the country’s largest single export by value.

Iran has tapped into its ample reserves of oil and natural gas in a different way, becoming a significant producer of plastics. Presently, plastics and rubbers constitute one-quarter of Iran’s exports.

How the Middle East Impacts the Global Economy

Given that the oil sector is one of the most significant in the global economy in terms of both volume and transaction value, many Middle Eastern countries are substantial players in international politics.

Nations such as Saudi Arabia and the UAE have direct impact on the oil market and play a pivotal role in determining the price of the commodity.

Due to the region’s massive exports (and imports of goods), and the importance of oil and gas in goods manufacturing worldwide, regional conflicts by Middle Eastern countries also impact global markets directly

The Top Middle East Exports by Country

November 4th, 2023

November 4th, 2023

Via Visual Capitalist, a graphical look at the top Middle East exports by country:

This entry was posted on Saturday, November 4th, 2023 at 5:03 am and is filed under Iran, Saudi Arabia, Turkey. You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.

ABOUT

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.