Last week, Turkish President Recep Tayyip Erdogan visited Central Asia twice. He first went to Uzbekistan to attend a summit of the Economic Cooperation Organization and then to Kazakhstan to participate in the 10th anniversary summit of the Organization of Turkic States. The trip was part of Turkey’s renewed engagement with Central Asia – which has seen Ankara increase trade, military cooperation and investment and reconcile politically with the governments of the region.

The eastern trajectory of Turkey’s outreach isn’t exactly new. Ankara has steadily boosted its cooperation with Central Asia over the past 30 years as it has strived to become a regional power. For the Turkish government, this requires reviving and unifying Turkic peoples and harnessing Central Asia’s many natural resources. However, engagement has always been hampered by distance, insufficient transport infrastructure, limited investment and low trade. Hence why Turkey has upped its game over the past year.

But there are several other factors that explain Turkey’s turn to the east. First, tensions between Russia and the West gave Ankara a new sense of urgency. Hostilities have given Turkey the opportunity to be an intermediary between Russia and the West and have opened up a new trade route between China and the West that bypasses Russia via Central Asia. Increased transit along the Europe-China route would bring some much-needed cash to the Turkish economy. Turkey is betting on the viability of the Middle Corridor, even as it, Uzbekistan, Turkmenistan and Iran sign a protocol to form a multimodal transport corridor that will be used to deliver goods from the Asia-Pacific to Europe.

Second, reduced energy exports from Russia have made Central Asian energy more attractive as Europe seeks to diversify its suppliers. Previous attempts to exploit the region’s energy – such as the Trans-Caspian Gas Pipeline, a planned project that would carry natural gas from Turkmenistan through Azerbaijan and Georgia to Turkey and on to the European Union – have failed due to cost, complexity or simply a lack of urgency. Kazakh oil is already flowing to Europe through Azerbaijan and Turkey, and in July, it started shipping via the Baku-Tbilisi-Ceyhan pipeline. This illustrates Ankara’s intention to become a Eurasian energy hub through which Europe will receive gas from Russia and Central Asia. (The Israel-Hamas conflict has only made matters more urgent, calling into question a planned gas pipeline from Israel to a liquefaction terminal in Cyprus, which will send liquefied natural gas to Europe. Turkey has since suspended its cooperation in the project.)

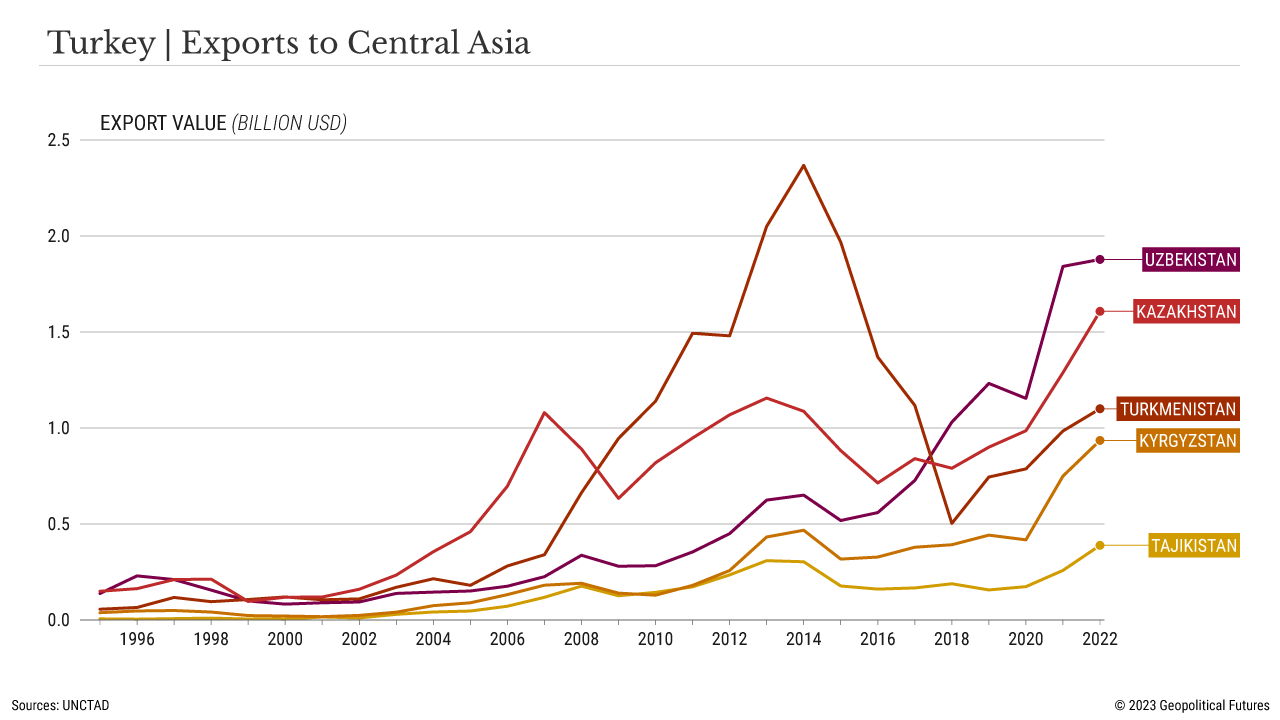

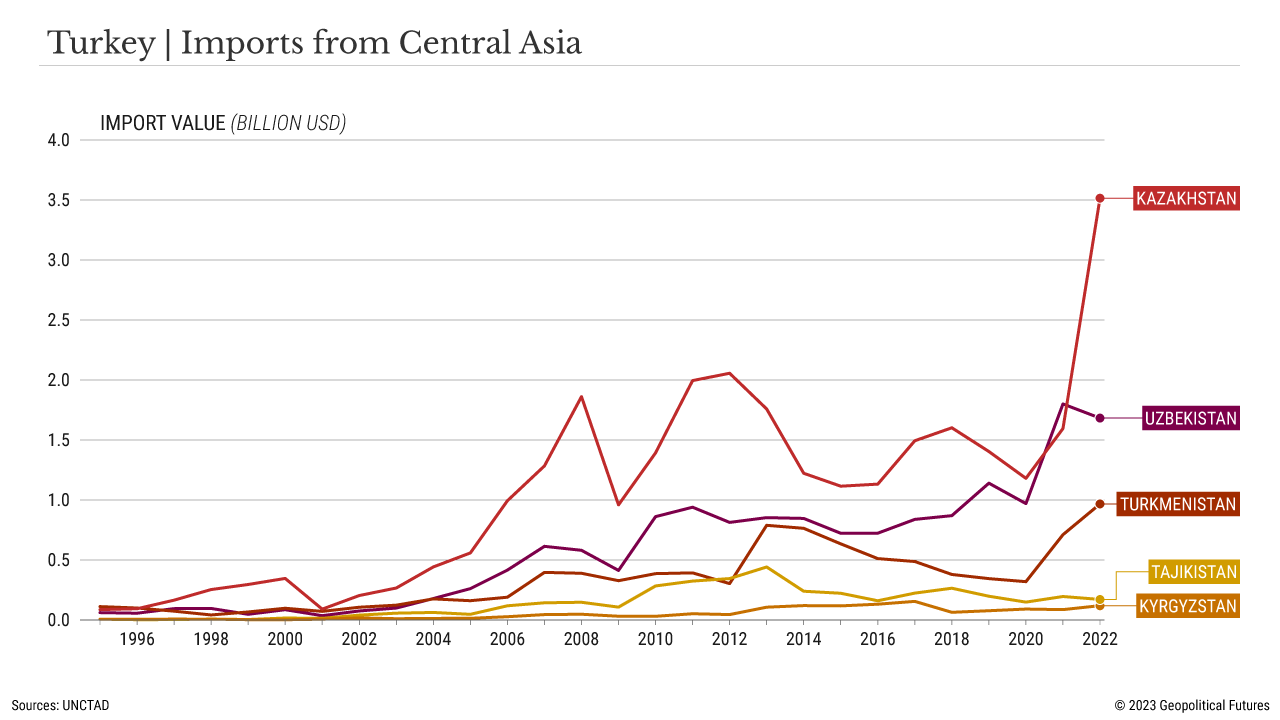

Turkey’s prospective EU membership also played a role in its pivot to the east. A few months ago, Ankara reminded Brussels of its application status when it agreed to stop blocking Sweden’s NATO application process. But after the European Parliament published a report in September on Turkey’s status, which Ankara said was full of unfounded accusations, prejudices and disinformation, tensions came to a head. Turkey threatened to walk away from the process, but in truth, the EU buys some 40 percent of Turkish exports, so it makes little sense for Ankara to cut ties, especially if it aspires to be a regional energy hub. The best Turkey can do is diversify its export markets.For all these reasons, Turkey has sought ways to do more business in Central Asia. The share of Turkey’s trade turnover with the region has grown. Last year, Kazakh-Turkish trade accounted for 4.7 percent of all Kazakh trade after a 54.4 percent increase in trade turnover. Also last year, Turkey became Uzbekistan’s fourth-largest trade partner thanks in part to a framework for a preferential trade agreement. Trade turnover between Turkmenistan and Turkey has reached $2.1 billion so far in 2023 – already higher than in all of 2022. Investment is also up. Turkish investment in Kazakhstan now exceeds $5 billion, making Ankara one of the country’s largest foreign investors. Over the past six years, the volume of accumulated Turkish investment in Uzbekistan has exceeded $3.5 billion, and in 2022 alone, they created 370 joint ventures in energy, industry, agriculture and materials production.

Finally, the wars in Ukraine and Gaza have diverted Russia’s and Iran’s respective attention and have thus allowed Turkey to expand its military presence in a region historically in their spheres of influence. This may allow Ankara to independently ensure security for future transport projects. Toward that end, Turkey and Kazakhstan entered into a defense agreement whereby Turkey will build warships for Kazakhstan. More recently, Kazakhstan’s defense minister traveled to Turkey to visit military installations and military-industrial facilities, including those run by the Turkish Aerospace Industries, which produces aviation equipment and unmanned aerial vehicles, and signed a bilateral military cooperation plan for 2024.For their part, Central Asian nations welcome Turkey’s attention. They need Turkey as an export market and as a way to circumvent Russia (and Western sanctions). Not only do they need investment, but they also need a diversification of investment; Russian money has dried up, and Chinese money risks a reliance Central Asian governments (and publics) don’t want. Turkey allows them to have a multi-vector foreign policy with tons of financial and logistical benefits.

To be sure, Turkey is capitalizing on the moment, but it’s important to note that although Ankara is becoming more indispensable to Central Asia, it does not pose a legitimate challenge to either Russia or China. It doesn’t have the financial or geopolitical clout to do so, and as the region grows more important, more countries will enter the competition.

Turkey’s Pivot to Central Asia

November 13th, 2023

November 13th, 2023

Via Geopolitical Futures, an article on Turkey’s renewed focus on Central Asia:

This entry was posted on Monday, November 13th, 2023 at 12:41 pm and is filed under Kazakhstan, Turkey, Uzbekistan. You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.

ABOUT

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.