Why Uzbekistan stands out

Uzbekistan’s economy and stock market are both standouts within the frontier market space for a wide variety of reasons. The IMF projects that growth will remain between 5-6% during the next 3 years, which is still well below its historical high. This strong growth will be spearheaded by the country’s new economic reforms and the increased FDI in Central Asia. The country’s new president has spearheaded a wide variety of market reforms since 2016, which will prove to be beneficial for the economy.

Central Asia will attract increased FDI in the future and Uzbekistan is poised to be a leader within this region ($170 billion in FDI in the next decade). The growth of tourism will be another supporting factor, as tourism has been picking up on the back of the visa liberalization measures. The number of tourists traveling to Uzbekistan nearly doubled during 2018. Other attractive characteristics include the country’s low level of public debt and high level of foreign exchange reserves.

Uzbekistan’s public debt fell below 20% during 2018 and is much lower compared to that of other frontier and emerging markets. Moreover, the country’s foreign exchange reserves, including gold, cover around 19 months of imports, which is typically unseen in the frontier market space. Uzbekistan is well positioned to be a leader within Central Asia, which will receive increased interest from foreign investors in the next decade.

Country Overview Area 173,351 mi2 Population 32.5 million GDP $48.7 billion GDP Growth 5.1% GDP per capita $1,462 Minimum Wage $25/month Inflation 17.9% Benchmark interest rate 16.0% Demographics Median age is 28.6 Unemployment 6.8% Source: World Bank/IMF/Trading Economics/UZE/Various (data as of 2018 or most recent)

The Appeals Of Central Asia: Massive Improvements Seen

Central Asia is poised to become a standout region for investment in the future, which will be driven by the region’s low cost of labour, abundant resources and relatively stable macro and political picture. Moreover, the region’s high youth/working age population is also another key asset for this region (median age in Central Asia is 26.7) Despite being landlocked, its geographical location is very strategic and notably allows it to attract foreign interest from both India and China (BRI) while the region is currently geopolitically overlooked.

BRI investments will be responsible for increasingly connecting Uzbekistan to other markets in Asia and Europe, while the country’s low wages, improved business environment and favorable demographics can allow the region to absorb economic activity from other markets in the future. According to The Boston Consulting Group, Central Asia has the potential to attract $170 billion in FDI during the next decade, including $40 billion in non-extractive industries. Central Asia faced a large number of struggles during 2014-2015, which led to Global X choosing to close its Central Asia-focused ETF.

Uzbekistan Stands Out In The Region

Uzbekistan stands out in particular for its relatively lower minimum wages, as well as its favorable demographics. Moreover, the country’s average wage of $225 is very attractive compared to regional peers. The country has a population of 33 million and 1/3 of the population is under 14 years old. Uzbekistan’s GDP per capita also lags behind its regional peers.

Country GDP Per Capita Population Uzbekistan $1,532 32.4 Tajikistan $826 8.9 Kyrgyzstan $1,281 6.2 Kazakhstan $9,331 18.0 Turkmenistan $6,967 5.8 Source: World Bank ( population in millions)

Uzbekistan’s economy still remained resilient during the commodity bear market, at a time when many of its regional peers suffered from an economic slowdown. Uzbekistan’s real GDP growth still remained between 5-8% during 2013-2017, compared to the average of around 7.9% during 2006-2017, while it averaged at 7.6% between 2006-2019. Diversifying away from commodities is the key moving forward and Uzbekistan will be able to benefit in the future from increased value-added exports and the expansion of various industries.

Uzbekistan’s Global Ranking For Reserves/Production Of Various Mineral Resources

Uzbekistan also stands out for its reserves and production of various mineral resources, which will draw increased foreign interest in the next decade. This provides the country with a strong to attract FDI from regional peers, while simultaneously using this as leverage to develop and improve other industries. Uzbekistan has ample room to increase its copper production in particular.

Reserves Production Natural Gas 24th 13th Gold 10th 10th Copper 10th 20th Uranium 16th 7th Source: BCG/Mining Technology/World Nuclear

Uzbekistan is also making massive strides to increase the capacity of various industries, including the cement industry, which includes plans to double its capacity. Moreover, the country can also move towards creating more value-added exports, which includes the ability for it to manufacture textile productsinstead of merely exporting cotton. This will ensure that Uzbekistan is able to diversify its economy.

Market Reforms

One of the key benefits of investing in Uzbekistan includes the newly implemented market reforms, which can serve as a catalyst to narrow Uzbekistan’s discount to other frontier markets. These reforms were implemented by the country’s newly elected president, Shavkat Mirziyoyev in December 2016 and they focus on creating a market-driven economy that focuses on private sector-led growth. These reforms, a massive contract to the country’s previous closed, centrally planned economy, will allow the country to liberalize the economy, increasingly cooperating with other countries, improve healthcare/infrastructure and to expand the country’s manufacturing base (high potential due to the low minimum wage in this country).

The World Bank recently ranked Uzbekistan one of the top improvers during its 2018 Doing Business Report, as the country is currently ranked 76th out of 190 countries. One key area that Uzbekistan needs to improve is strengthening anti-corruption efforts, as the country is currently ranked 158th out of 175 countries in terms of corruption according to the World Bank.

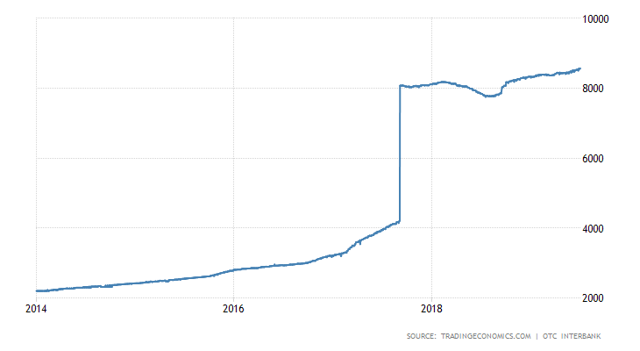

Currency Has Stabilized

The country’s currency has also stabilized substantially, following the massive devaluation experienced when the country removes its peg against the USD. The currency only depreciated by circa 2% during 2018, while other frontier and emerging markets in Asia such as Sri Lanka and Pakistan experienced massive devaluations against the USD. This is further supported by the fact that foreign exchange reserves cover nearly 19 months of imports according to the IMF.

Appeal Within Frontier Markets

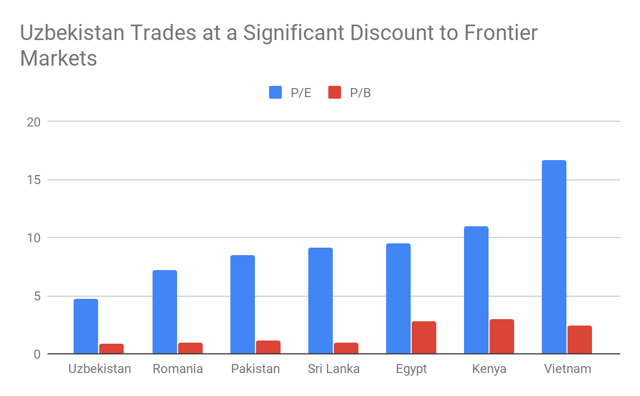

Uzbekistan’s favorable macroeconomic characteristics will serve as a catalyst to remove Uzbekistan’s wide stock market discount to other frontier markets. Valuation for listed equity is at a low that is unseen within the frontier market space, though liquidity is a significant barrier. The market reforms that the country recently implemented will be a major catalyst for future economic growth and will make an investment in this market appealing.

Apart from strong growth, the market is also appealing due to its high level of foreign exchange reserves, the low level of public debt, favorable demographics and stable currency. Uzbekistan is a stable market for investors to consider at a time when other Asian frontier and emerging markets such as Sri Lanka and Pakistan have been experiencing economic and political issues, which have resulted in poor performance of the country’s currency and stock market in recent years.

Uzbekistan’s low level of public debt is very attractive and is only topped by select frontier markets such as Bulgaria, Kazakhstan and Morocco. Uzbekistan’s public debt actually dropped even further during the first half of 2018, equivalent to less than 20% of the country’s GDP. The country also has the world’s 17th lowest debt per capita out of a group of 184 countries.

Uzbekistan’s average GDP growth during 2004-2017 was 7.6%, which portrays that Uzbekistan would become one of the world’s fastest growing economies if the country were able to return growth to historical norms. It is actually feasible for Uzbekistan to trump this average growth rate in the next decade on the back of increased FDI and the realization of benefits from the market reforms implemented, which would result in increased interest in the country’s stock market. Furthermore, Uzbekistan’s growth was even able to be resilient and deliver growth above 5% during 2014 and 2015, during the years when its regional peers and other commodity-oriented economies struggled.

The main risks at the moment include the potential overheating of the economy and the poor liquidity of the stock market. In recent years, Uzbekistan has seen a surge in imports, which has resulted in a CA deficit. Moreover, inflation has yet to drop to the single digit levels, which will put a strain on domestic consumption and also make it difficult for the country to have much needed additional interest rate cuts. Industries that are heavily dependent on FDI, such as the cement industry, could see cyclical downturns in the next 2-3 years, though there is no current risk of short-term oversupply in this market. The main negative characteristic of this market is the highly inaccessible nature of the equity market for investors that do not have a 3-5 year investment horizon.

Accessing The Market

For US investors, the only way to access the market is to either invest directly or to invest in a fund with exposure to the country. Seeking Alpha contributor Asia Frontier Capital invests in the country and also posted a travel note that mentions several US-listed companies that have exposure to Uzbekistan.

Cherry-picking markets such as Uzbekistan that stand out for higher economic growth and lower stock market valuation is one way to outperform MSCI Frontier Markets (FM). A large number of US companies have entered the market or expressed interest in entering the market. According to the Uzbek Foreign Ministry, companies such as General Motors (NYSE:GM), Exxon Mobil(NYSE:XOM) and John Deere (NYSE:DE) are entering the market.

Uzbekistan: Most Intriguing Market In Frontier Asia

July 15th, 2019

July 15th, 2019

Via Seeking Alpha, a positive look at Uzbekistan:

Summary

- Uzbekistan is poised to be a leader in Central Asia and is a standout country among other frontier markets.

- Market reforms that were recently implemented in 2016 will support private sector-led growth.

- Uzbekistan stands out in particular for its relatively lower minimum wages, as well as its favorable demographics. The country has a population of 33 million and median age of 28.

- The equity market is extremely undervalued and there are macro catalysts ahead to narrow its discount to MSCI Frontier Markets.

This entry was posted on Monday, July 15th, 2019 at 1:12 am and is filed under Uzbekistan. You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.

ABOUT

Focusing primarily on The New Seven Sisters - the largely state owned petroleum companies from the emerging world that have become key players in the oil & gas industry as identified by Carola Hoyos, Chief Energy Correspondent for The Financial Times - but spanning other nascent opportunities around the globe that may hold potential in the years ahead, Wildcats & Black Sheep is a place for the adventurous to contemplate & evaluate the emerging markets of tomorrow.